Intro

Still undecided between Ally and Digital International Bank? The best way choose is to compare their features side by side so you can see which bank is the better option.

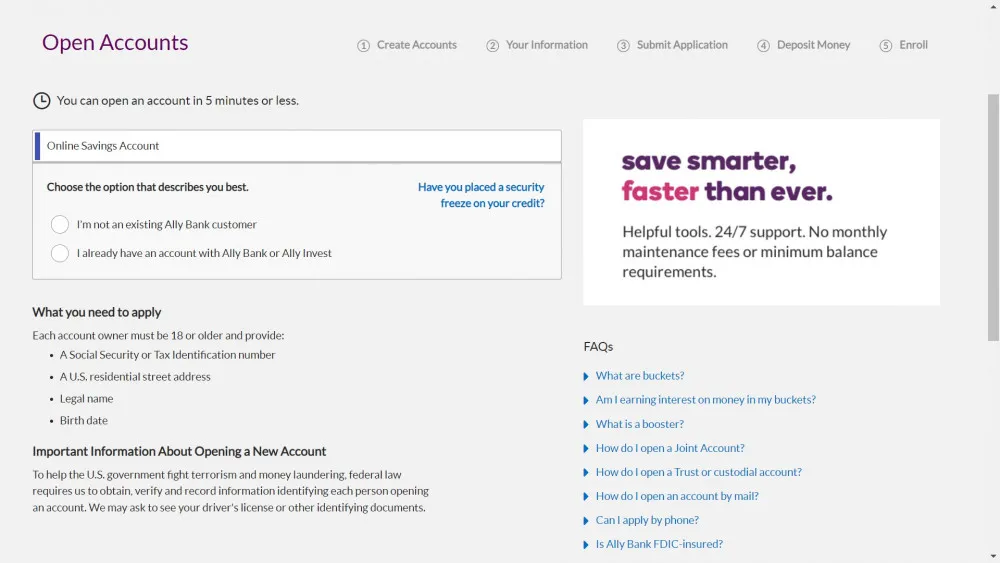

Only US citizens and residents are allowed to sign-up with Ally so if you're not residing in the big apple, then you're not eligible register for a bank account.

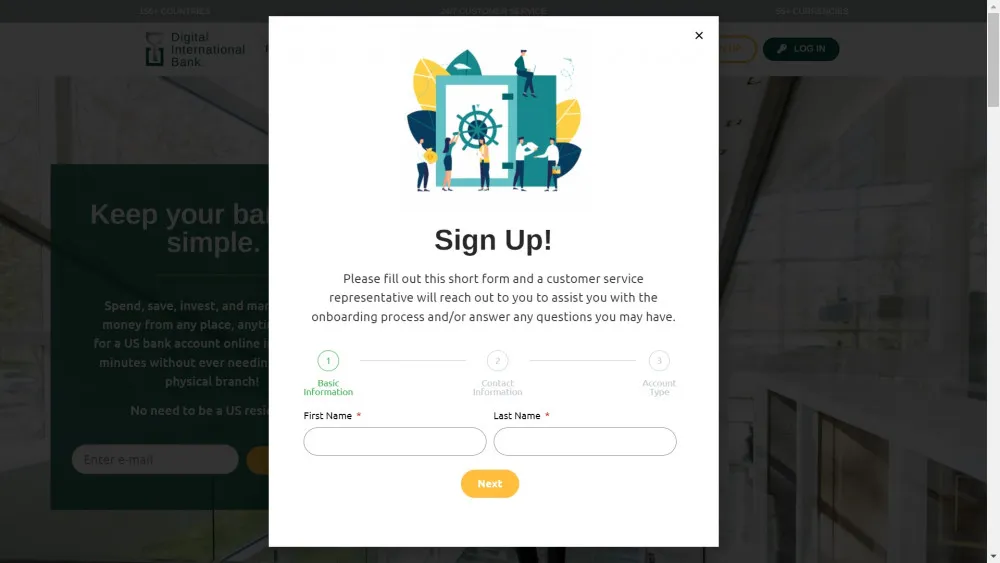

As for Digital International Bank, it currently allows registrations of users from over 150 countries and this makes them a truly global company. It's worth noting that US residents are also included in this list.

Aside from USD, Ally also supports 6 more currencies and this includes EUR, CAD, JPY, CHF, AUD, and GBP.

A DIB account on the other hand accepts over 55 currencies. The advantage of having multi-currency is that helps you save on exchange fees since your account is capable of accepting your preferred currency.

Ally Bank clients are only eligible to get a MasterCard while Digital International Bank customers are provided with a Visa card.

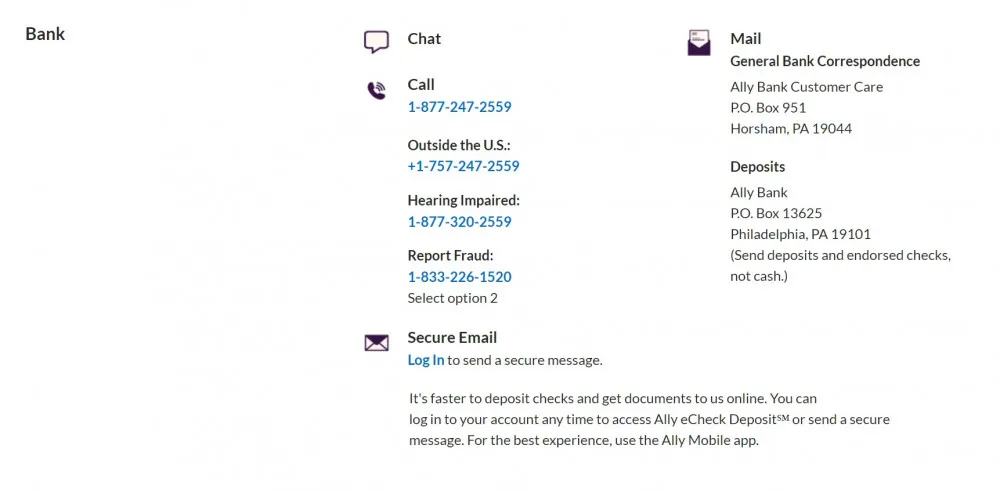

Getting in touch with the Ally customer support team is possible by phone, email or live chat. These are actually the most common ways of contacting a bank's customer service department so it's good to know that they offer these options for their clients.

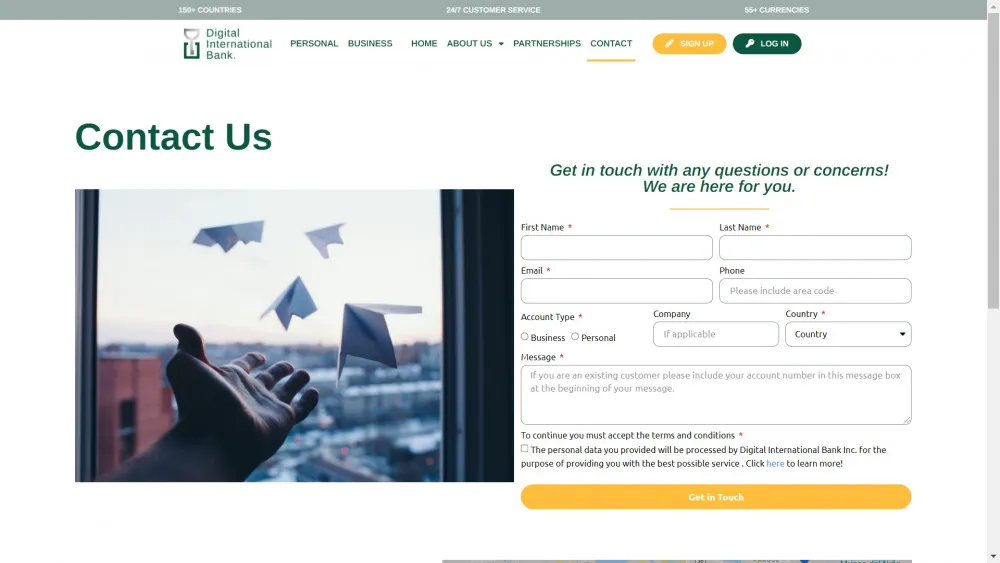

As a DIB client, you can contact their customer service team via phone, email or even video chat. They are given more options to get client assistance via different channels.

Ally Bank currently has around 3 million clients in the US and is highly popular amongst users who prefer digital banking services. What gives them the edge over other US digital banks is that they offer much competitive rates and low fees.

The Digital International Bank brand has been praised for providing a unique service which is called hybrid banking. This is an amalgamation of traditional banking, which is still mainstream, and the innovative features of digital banking. Aside from this, DIB is also licensed bank and is regulated by US federal law.

Both Ally and Digital International Bank have their pros and cons but it can't be denied that these are pretty good choices if you're considering to open a digital bank account. Ally offers a user-friendly banking app with competitive rates and low fees but the downside is that it only supports US residents. With Digital International Bank, you'll have the opportunity to experience their hybrid banking service which combines the best of both the traditional and digital banking features and the added perk is that it accepts users from over 140 countries. Basing on the comparison that we did, DIB is the better choice.