Wise is a Fintech (Financial Technology) company with its feature to send cash from the U.S. to approximately 80 countries. Known by its former name, "TransferWise," Wise allows you to transfer funds through several options at lesser fees. However, it will require that your recipient must first have a bank account.

Wise is widely known for its user-friendly experience. If you are looking for an affordable and easy way to transfer funds internationally, Wise can provide you with a couple of benefits.

Did you know that digital banking offers many benefits and this includes the convenience of being able to transact from anywhere? If you're interested in opening an account with a digital bank, then here are the top 3 names in the industry to consider:

| Operator | Card | Reliability | Best in | Score | |

|---|---|---|---|---|---|

#1

|

Visa, MasterCard | Low and transparent fees with mid-market exchange rates | International Money Transfers | 97 | Open Account |

#2

|

Visa | Online banking with no monthly fees | Spending Account | 96 | Open Account |

#3

|

Visa | Hybrid banking with quality support | Hybrid Banking | 94 | Open Account |

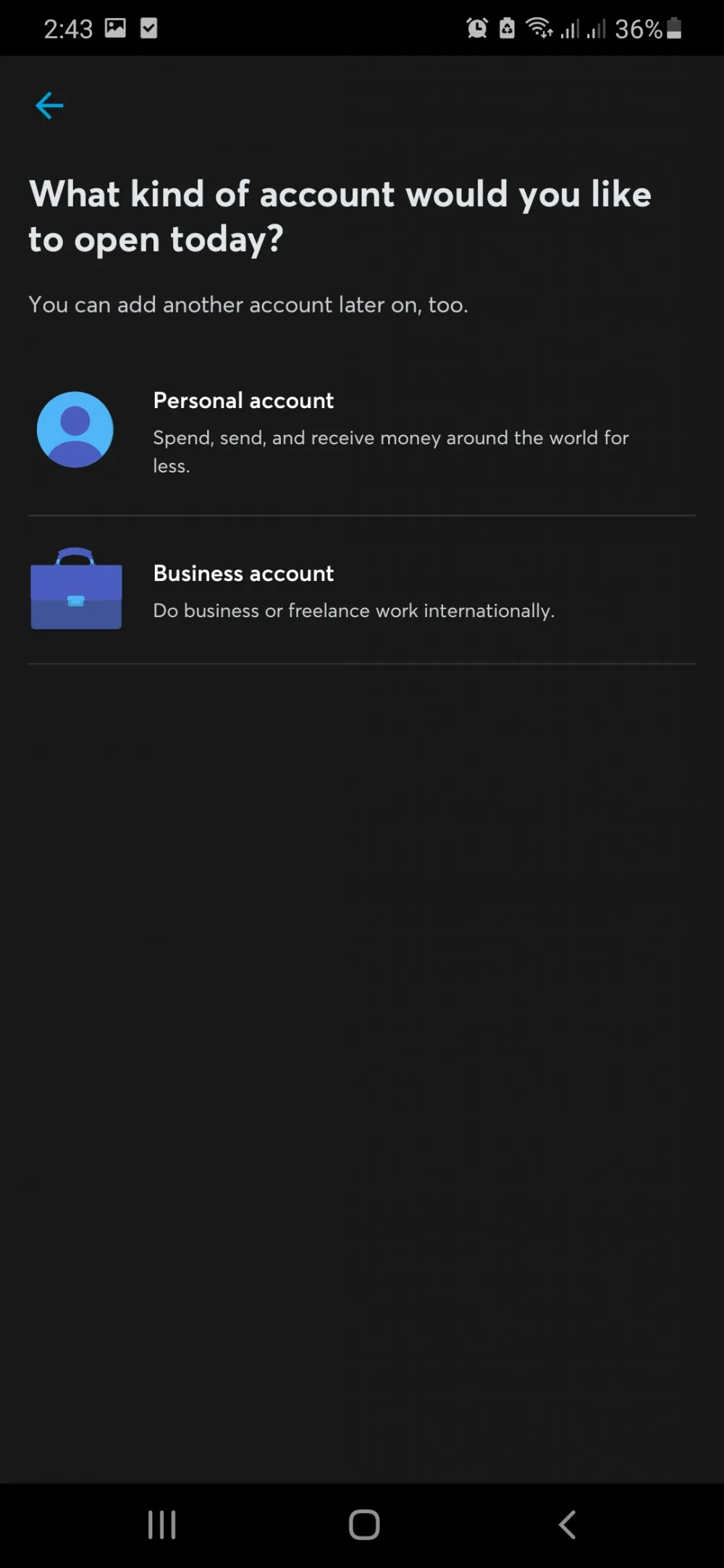

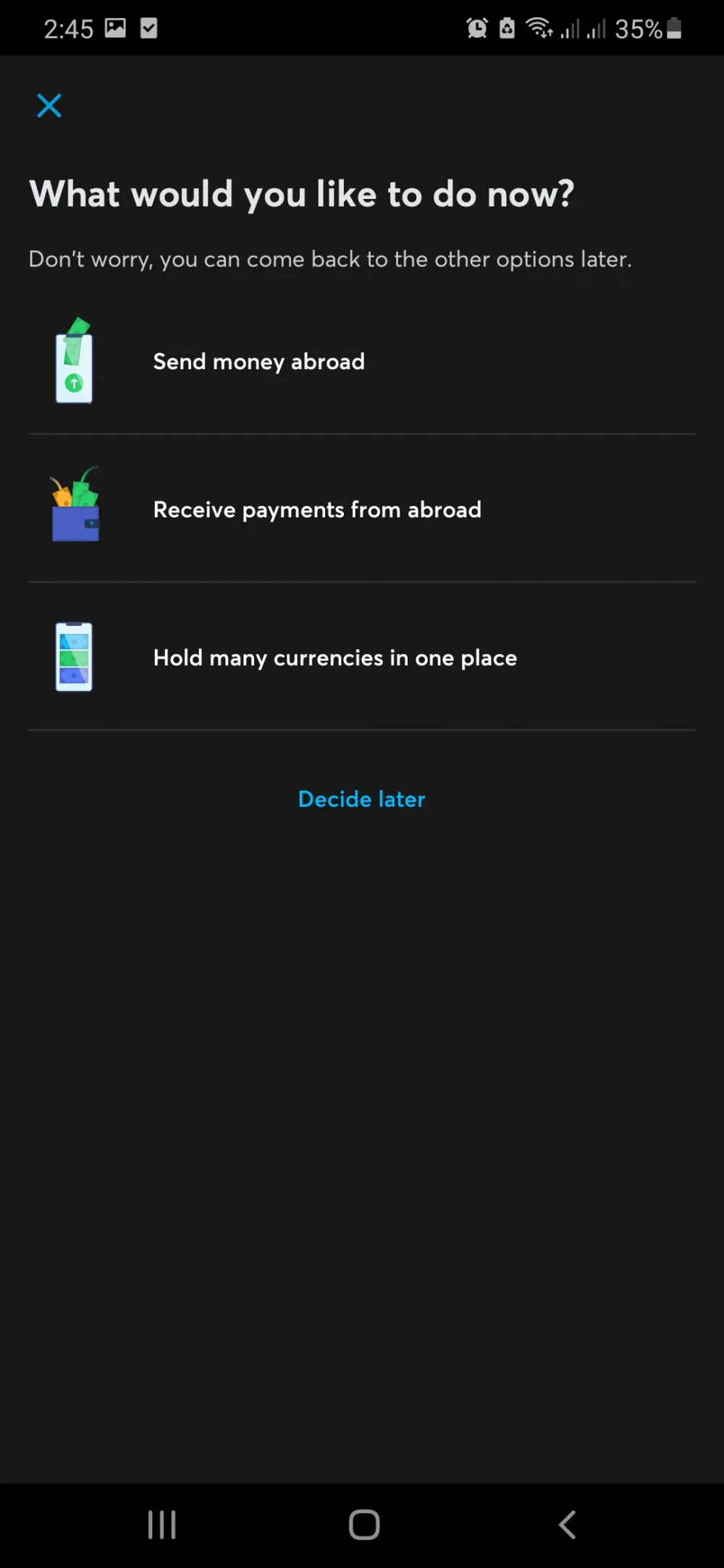

Wise offers personal and business accounts, so it doesn't matter if you will use it for your private transactions or use it for your business. You can get a multi-currency account for the personal account that allows you to manage more than 50 currencies. Not only that, but it also enables you to send funds at their real-time exchange rate.

Setting up an account on Wise is free. However, some products and services have costs, but they offer them at the lowest possible price. This includes but is not limited to:

Wise gives assurance of the safety of each client’s account. Just like some of the leading banks and other financial institutions, Wise has a layer of protection that keeps your accounts and transactions safe.

Wise accounts are different from bank accounts as you can only store your money and spend it in the future. Unlike banks, funds held here do not accumulate interest, unlike bank accounts. A Wise multi-currency account can only be used to store, send, receive and spend funds, and all transactions follow the real-time exchange rate.

Opening a bank account with Ally only takes a few minutes of your time. You can follow the simple procedure below:

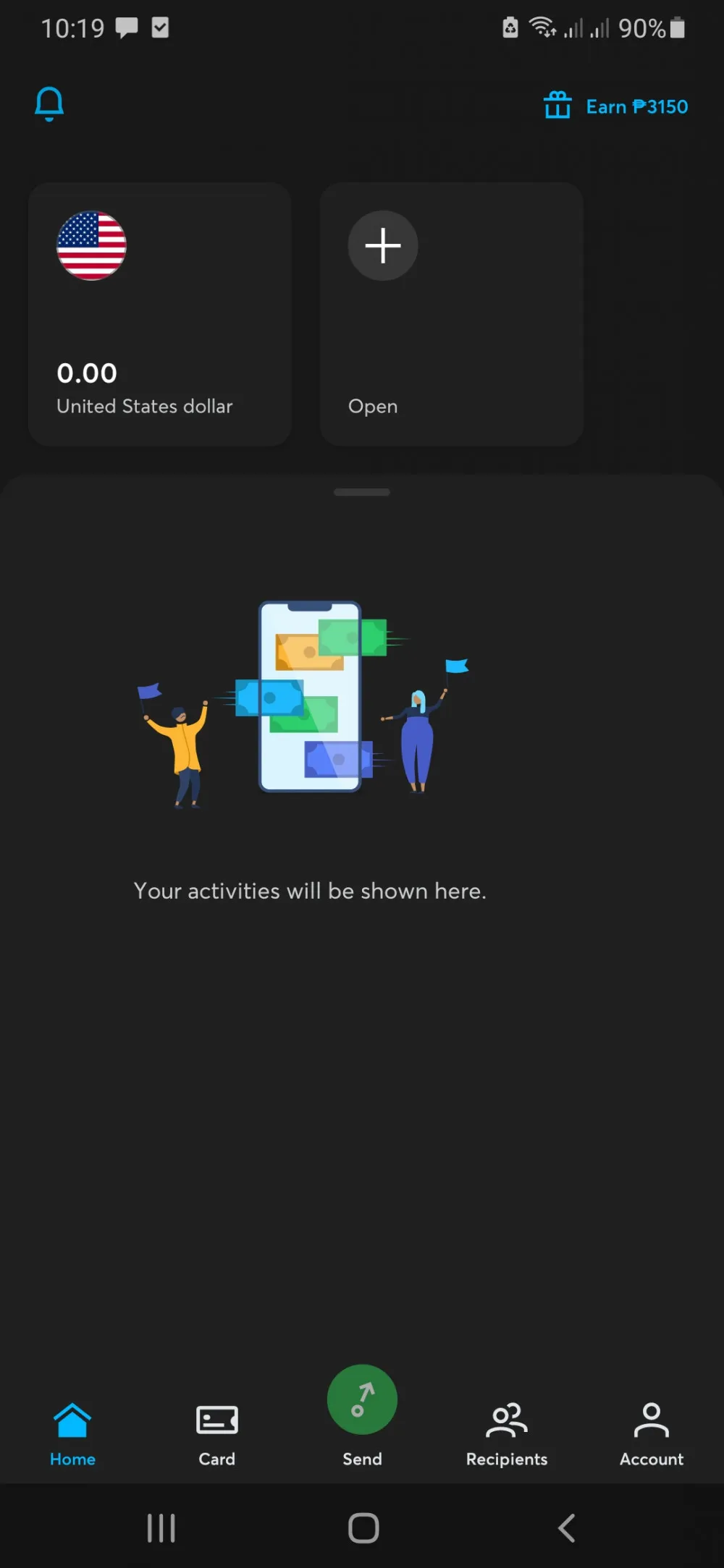

Wise mobile application is available for iPhones, iPads, and Android devices. You can use them to send money abroad from any location that has access to the internet. You can check the status of your transfers and cancel them if necessary. Whether you're online or in a branch, the app has all the information you need to make a bank transfer and make debit or credit card payments.

Here’s what you can do with the Wise App:

Wise is safeguarded with leading banks. This is to ensure that the Wise have enough capital and have a strong foundation to handle many transactions in a day through their app. It is also licensed by the Brazilian Central Bank to make sure that your money is protected and insured.

They send API access credentials which include the client ID and client password. Using this two-way authentication to protect your information, this guarantees more secured transactions. In addition, they verify the data and information and ensure that they are well-protected from any fraud or scam.

You can use Wise to pay with currencies such as the British pound, Australian dollar, Romanian Leu, Euro, New Zealand dollar, Singapore dollar, US dollar and Hungarian Forint just like paying in a local store or shop.

There are no hidden fees because Wise outright show you how much they charge you. There are two types of fees that Wise charges which are the following:

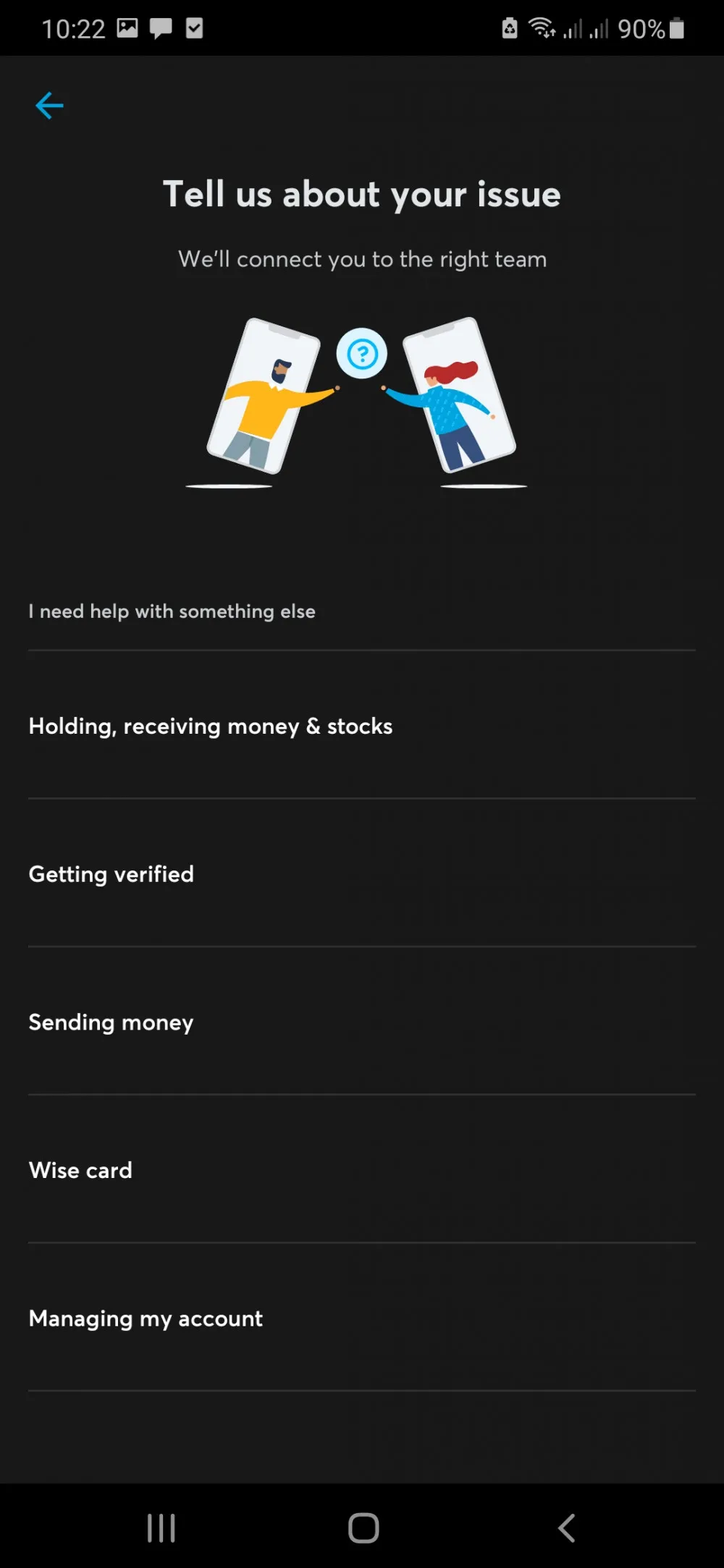

You can reach their customer support through email, phone, social media, and even live chat all year round. Their support team can help you from various regions with different languages. Many of the frequently asked questions can be found on their website. When it comes to the trust and safety of Wise, fees for customer reviews, and multi-currency account support, customers can visit the Wise help center website for more information.

Wise gives you different ways to contact them, but if you need a quick response, we advise you to give them a call if you are in the US as this is the easiest way to get a response, and your concern or question can be addressed right away. If you are outside the US, they can be quickly reached by their live chat.

Wise is a fintech allowing you to store your money and use it in the future, particularly spending or transferring your funds. It is known for its quick and affordable transactions, mainly fund transfers. Just like banks and other financial institutions, Wise will require your information so that they can use it for your future transaction.

Wise prioritizes your safety and convenience. That is why it invested in multiple layers of securities that safeguard and monitor your funds. All fees are straightforwardly charged at the lowest cost possible.

Unlike banks, Wise does not provide you the privilege to earn interest on your fund. They prioritize more on providing you the ability to transact anywhere in the world with a real-time exchange rate while charging the lowest cost possible.