Remitly, launched in 2011, entered the market with a straightforward mission: to simplify the process of sending money across borders. At its core, Remitly is known for international money transfers. It extends its services to mobile money and direct bank deposits, among others. Notably, it operates in multiple countries, supporting various currencies, which has endeared it to a global clientele.

This review aims to offer an unbiased perspective on its services, gauging whether it lives up to the promise and where it stands in a crowded marketplace.

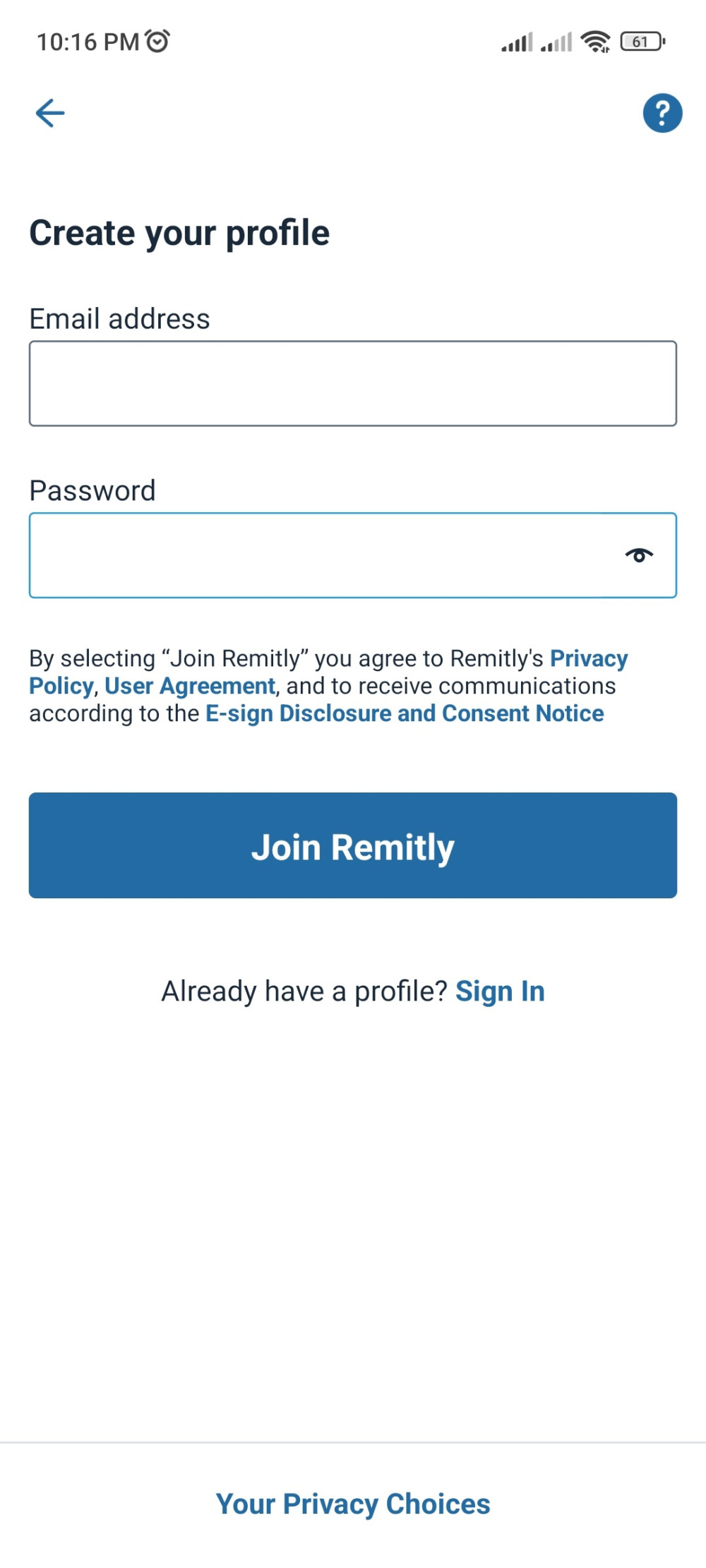

Registration for an account is relatively straightforward and requires very basic essential details, coupled with identity verification. During the quick registration process, you'll only need to provide the following:

Take note: Regardless if you prefer to sign-up via their website or the app, the required details are the same.

The platform, both app and website, is designed with intuitiveness in mind. Clear labels and logical flow make it user-friendly, even for the less tech-savvy. It boasts a clean design with a focus on functionality over flair.

The mobile app is optimized for on-the-go transactions, with easy-to-access features, while the web platform offers a more expansive view.

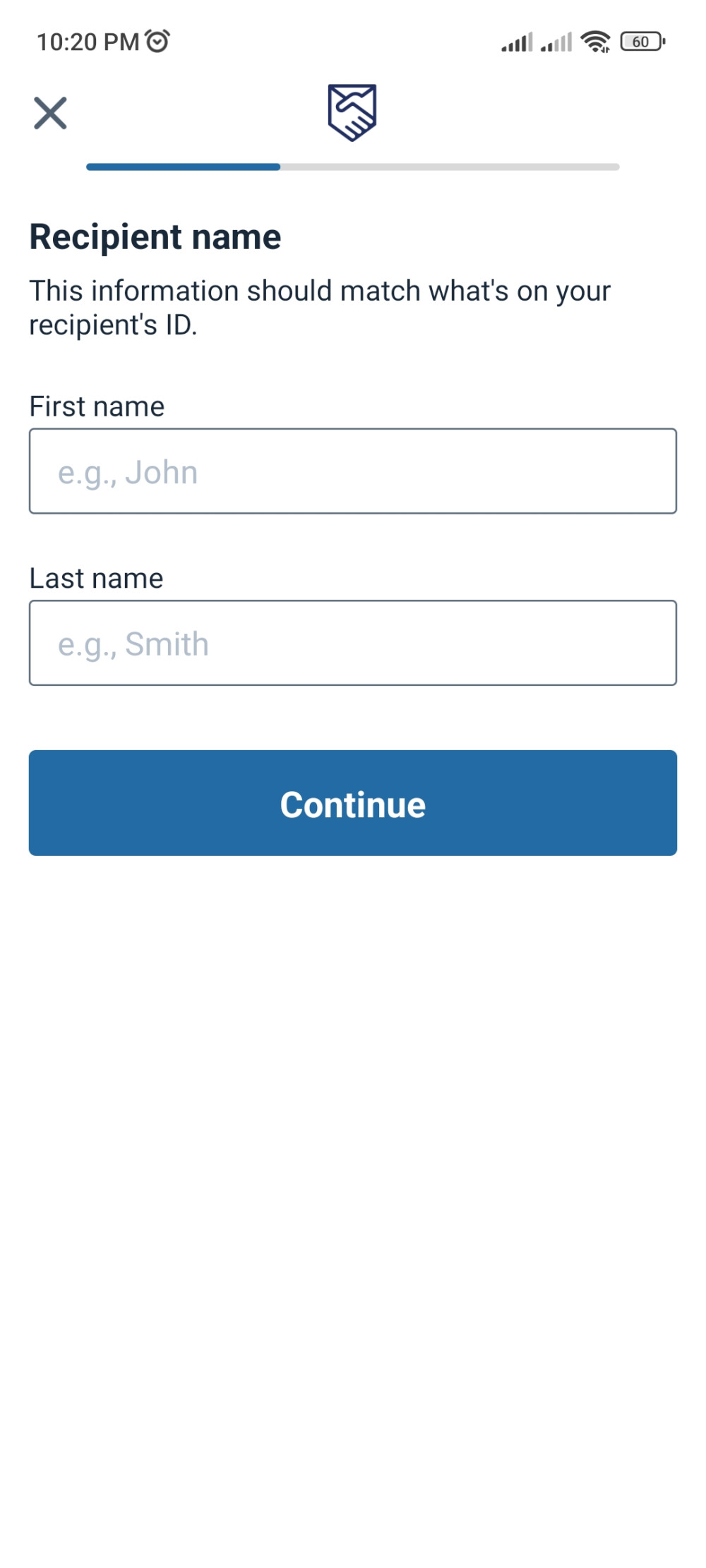

Initiating a transfer is simple. Users need to select the recipient's country, enter the amount, choose the delivery method, and make a payment. Options vary from direct bank transfers to mobile credits.

Transaction speeds often align with advertisements; however, delays can arise from external factors. There are also set transaction limits, primarily depending on the user’s verification level and the receiving country.

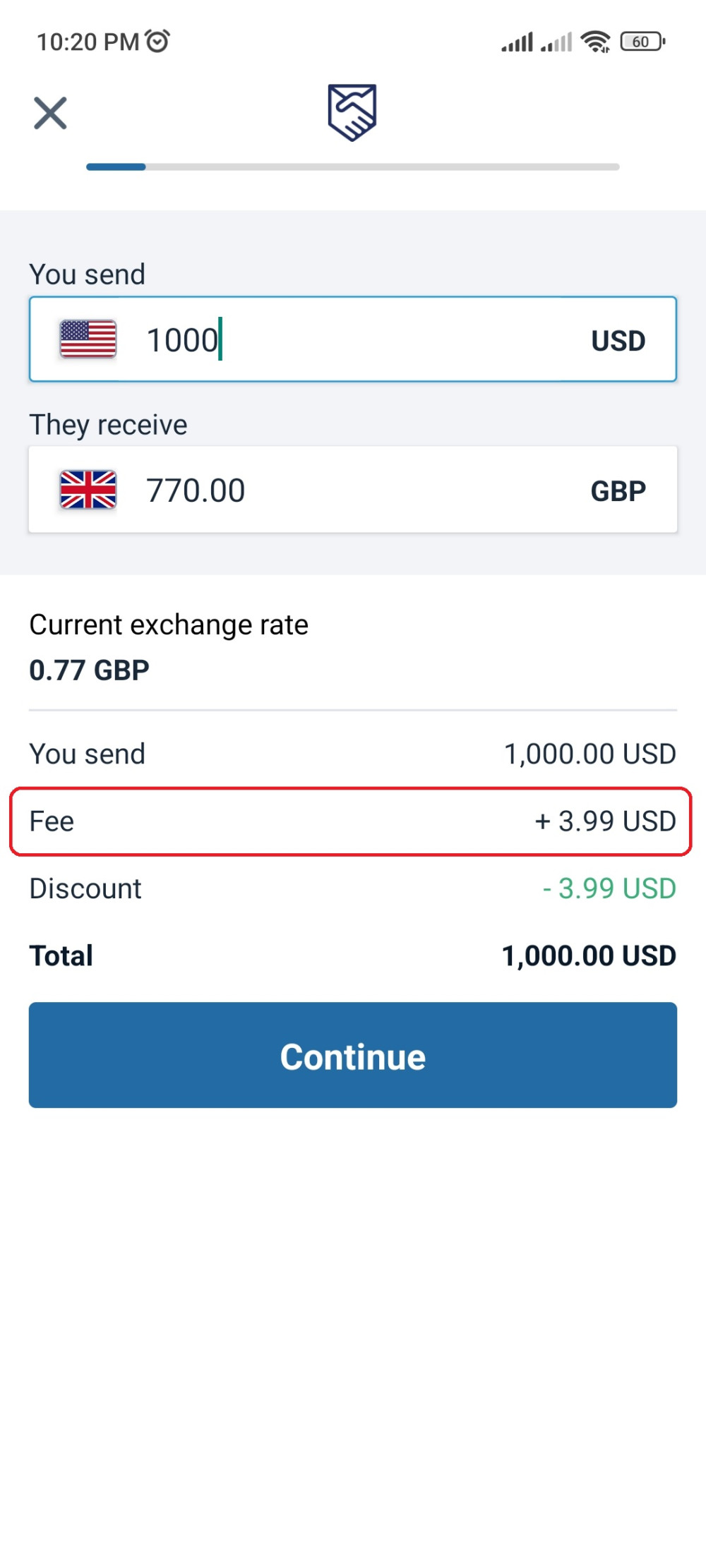

Remitly has a mixed fee structure. Depending on the transaction, fees can be fixed, percentage-based, or sometimes both. Compared to competitors, its rates are competitive, though not always the lowest.

One commendable aspect is the transparent fee disclosure, ensuring users aren't caught off-guard by hidden charges. You'll be able to clearly see the transfer fee that you'll need to pay during the transfer process.

When using Remitly, you are presented with secured payment methods to facilitate your money transfers, ensuring both convenience and safety:

What we liked about Remitly is that it provides its users with flexible options to cater to both immediate and non-urgent money transfer needs, all while maintaining a high level of security.

Security is paramount for Remitly. With robust encryption and anti-fraud measures, it ensures safe transactions. While no platform is immune to negative reviews, large-scale fraud complaints are minimal.

Additionally, Remitly holds licenses from various financial authorities worldwide, bolstering its credibility.

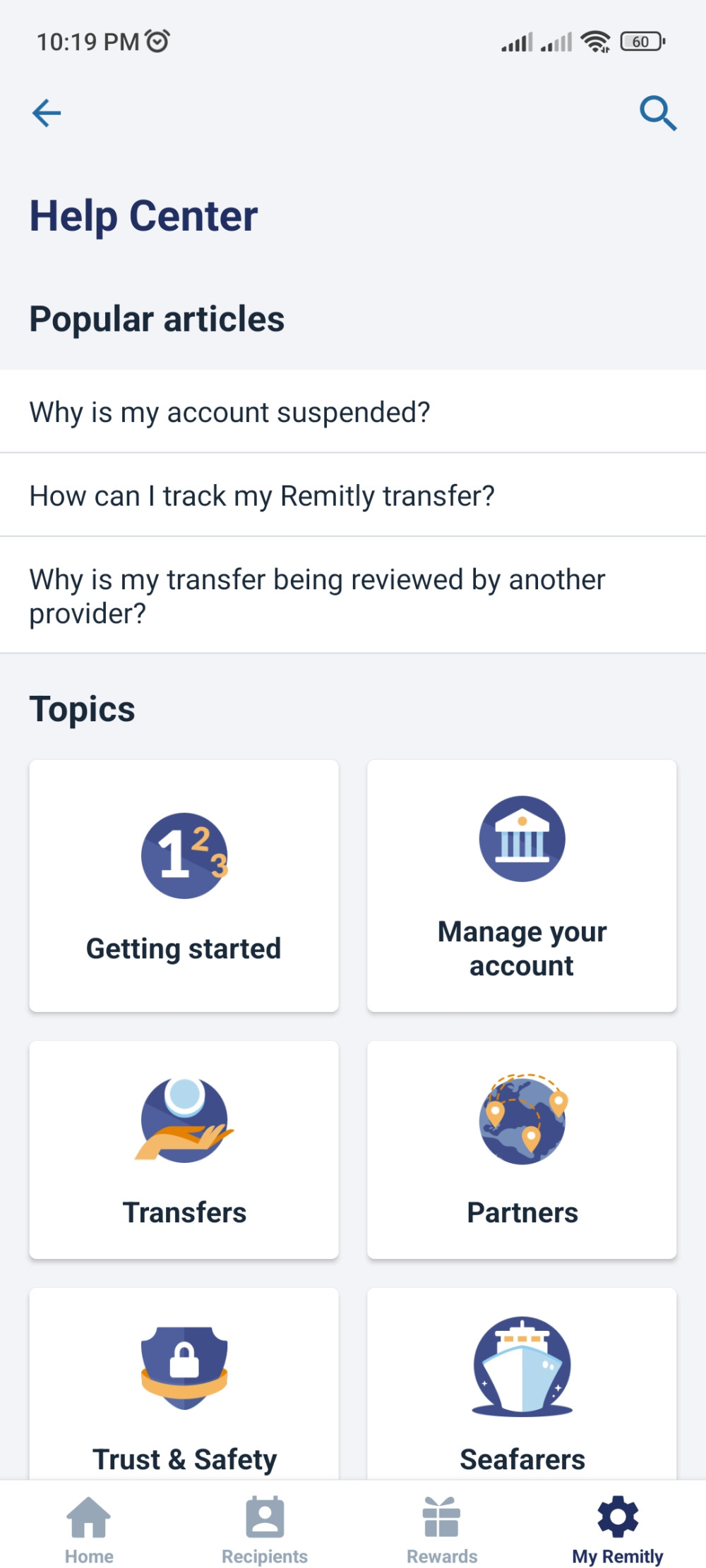

Accessible virtually 24/7, Remitly's customer service can be reached via email, chat, or phone. Responses are usually prompt. However, the quality of support can vary. In addition, it has a comprehensive but user-friendly Help Center that you can access for getting lots of useful information.

While many representatives are knowledgeable, a few users have reported mixed experiences. In our case, we were very satisfied on how their agents were able to assist and accomodate us with our queries and concerns.

In comparison to giants like Wise (formerly TransferWise) and Western Union, Remitly holds its ground, especially in terms of transparency and ease of use. However, Wise often undercuts with fees for some routes, and Western Union's vast offline reach is unparalleled.

Remitly's strength lies in its user-friendly interface and its balanced mix of online convenience with multiple delivery methods.

Our personal dalliance with Remitly was mostly positive. The transactions were seamless, and the minor hiccups encountered were swiftly addressed by their support team.

We'd recommend Remitly to those prioritizing ease-of-use and varied delivery options. For those fixated on fees alone, shopping around might be more beneficial. For new users, always verify the current exchange rates and fees before proceeding with transactions.

Remitly has carved a niche for itself in the competitive realm of money transfers. Its strengths lie in its user-centric design, transparency, and varied delivery options. While not without its imperfections, it remains a viable choice for many, especially those new to the world of online transfers.