Starling Bank was founded by Anne Boden in 2014. Boden brought her extensive resume that includes vast working experiences with Lloyds, CHAPS and Allied Irish Bank. In 2016, Starling Bank gained popularity when it launched United Kingdom's first mobile-only banking account. Today, the bank has become known for its delivery of one of the most reliable banking services in the UK.

| Operator | Card | Reliability | Best in | Score | |

|---|---|---|---|---|---|

#1

|

Visa, MasterCard | Low and transparent fees with mid-market exchange rates | International Money Transfers | 97 | Open Account |

#2

|

Visa | Online banking with no monthly fees | Spending Account | 96 | Open Account |

#3

|

Visa | Hybrid banking with quality support | Hybrid Banking | 94 | Open Account |

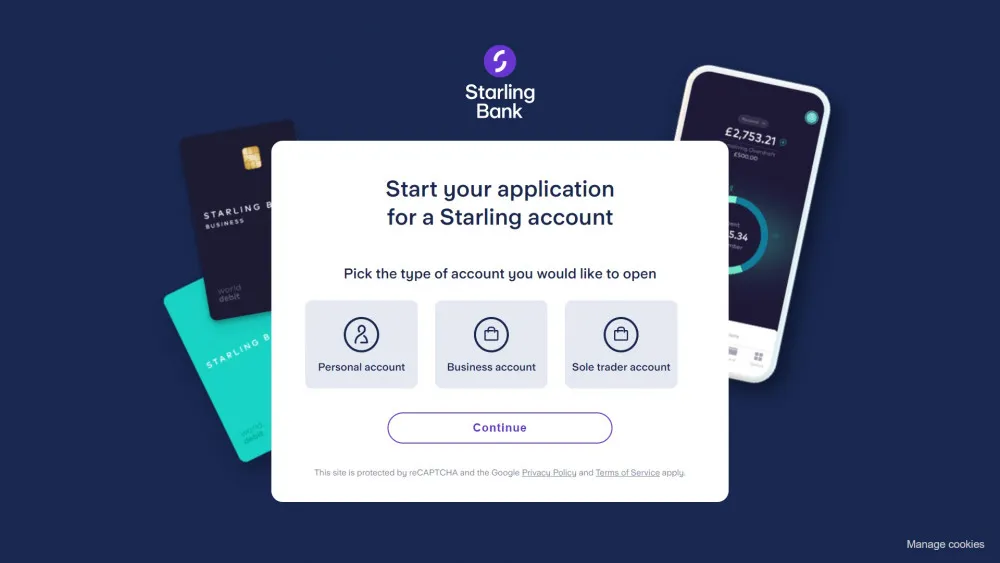

Starling Bank has different accounts that cater to different needs. Be sure to know all the features and perks of each account to determine which one suits you best.

In opening a Personal Account, you don't need to visit a physical branch nor set up an appointment. All you need to do is download the Starling Bank app on your mobile phone and open your account from there.

Below are the very basic conditions for opening a Personal Account:

Same with traditional bank accounts, as a new account holder, you will get a Mastercard debit card that you can connect to your digital wallets like Apple Pay.

You'll be also be permitted to have up to 6 cash withdrawals a day with a maximum of £300.

As for cash depositors, you can deposit at more than 11,500 UK Post Office branches all over the United Kingdom at a maximum of £5,000 every year.

In addition, Starling also gives you the option of turning on or off an overdraft within the app. If you take full advantage of this feature, you will be charged with 15% starting AER for the amount you borrow. When approved, you'll have the chance to set a limit on the amount you think suits your needs and can turn it off anytime.

A personal loan option is also available if your account has an active overdraft. This allow you to borrow money with an amount ranging from £500 to £5,000. The interest rates for these loans starts from 11% up to 15%.

A Joint Account is a good choice for couples, friends or even business partners wanting to keep equal share of financial responsibilities. Starling Bank's Joint Account allow you to manage collective expenses like bills and savings with your co-holder. You can easily open a joint account if you already have a personal account and your co-account holder is nearby for the joint account scanner to locate. Just press "accept" after it finds your co-account owner and you now have a joint account.

Starling Bank also offers a Teen Account for 16 and 17-year-old teens. This account has all the features of the Personal Account except for the ability to take out loans and get overdraft protection.

For opening a Euro Account, the process is easy, and the conditions are agreeable. This type of account is ideal if you regularly receive or send euros. After opening a personal bank account, you can use the app to add a second bank account, like with a joint account.

Then, once the account is opened, you will get an International Bank Account Number that you can use for international transactions. To convert pounds to euros or vice versa, you'll be charged 0.40% plus the real-time exchange rate.

A Business Account is also available with Starling Bank. In this account, you will also get all the features of a personal account, plus there are no monthly charges. Fees include £3 for deposits and £0.50 for withdrawals. However, if you meet the criteria, you can enjoy a business overdraft. The business account can be integrated with the mobile apps' other tools like Xero and FreeAgent.

Because it is a Business Account, it takes additional time opening it than a personal account.

Opening a Starling Bank account only takes a few minutes of your time. You can follow the simple procedure below:

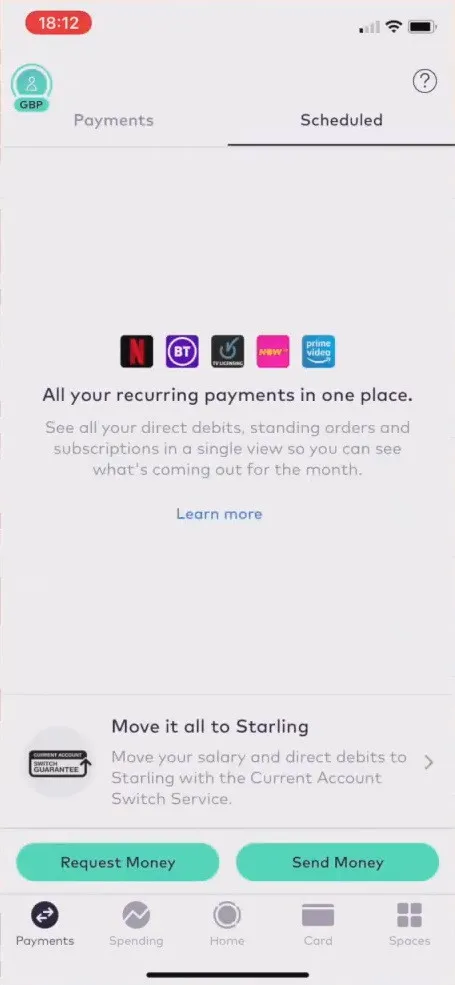

Other than the aforementioned “Marketplaces”, Starling Bank has a sterling set of features most bank account holders who are adapting mobile banking would find useful. Here are several of those features:

Compared to traditional banks, Starling Bank doesn't charge many fees. The basic banking services and transactions are free while monthly maintenance fees and international and domestic ATM withdrawals are incurred. Account holders can also deposit cash at ATMs for free, however they must visit their local post office to do so. There is however, a £2 monthly fee for holders of Business Euro Account and a £5 monthly fee for a Business US Dollar Account.

There is zero charge for domestic money transfer transactions, but international money transfers will cost a fee. Account holders will have to pay a fee based on how much cash they are sending and to where country it's going. Overdraft fees are another fee users will have to pay. The effective annual interest rate (EAR) can range from 15% to 35% depending on the credit score. There is however, an arranged overdraft option available at Starling. Depending on the customer's credit score, interest is calculated daily and charged at 15%, 25% or 35% EAR. Unarranged overdrafts are not subject to additional charges.

Another good news, in April 2020, Starling Bank announced that account holders won't be charged with an interest or a fee for any unauthorized overdraft.

There are several financial options within the Starling Bank app in addition to its standard banking services. For personal loans, Starling provides loans of up to £5,000 either as a "spread the cost" arrangement or as a "apply beforehand" arrangement at competitive interest rates ranging from 11% to 14.5%

The "apply beforehand" loan operates like a typical loan, wherein the "spread the cost" option takes effect following a purchase transaction that it finances through a term.

Starling Bank also offers mortgages and loans in its "Marketplace" feature with several banks and financial institutions it has partnered with. These include credit building apps such as Credit Ladder and financial apps like Habito and Wealthify, as well as discounts on premiums for life, asset and home insurances.

The Financial Services Compensation Scheme (FSCS) provides insurance of up to £85,000 against bank failure, and Starling Bank adheres to the Contingent Reimbursement Model (CRM).

The CRM is a voluntary industry code that gives you the right to get a refund for any unauthorized transactions made from your account. This also includes occurrence of sending you money to scammers voluntarily for reasons of being tricked by someone who pretended to be part of the bank's security branch.

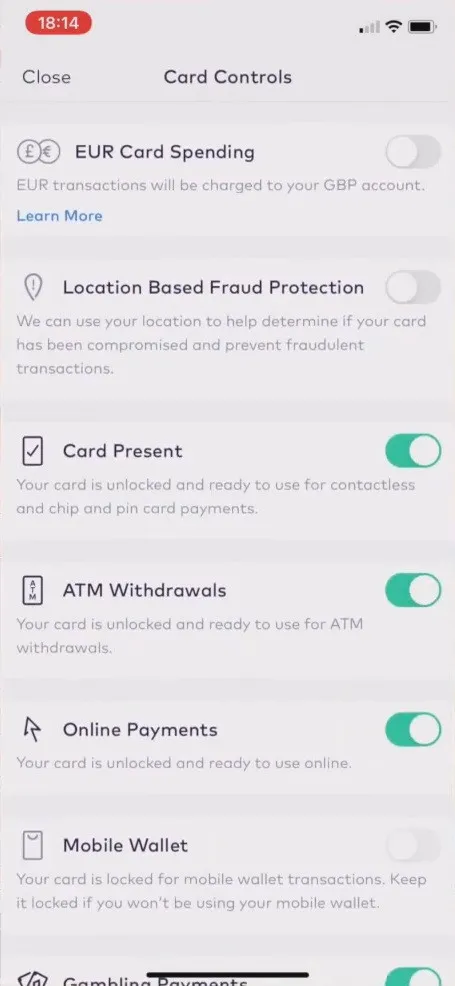

There are several security features included in the Starling Bank app and card, including a passcode, fingerprint and facial recognition. If you lose your card or had it stolen, you can deactivate it immediately in the app, and customer services are available.

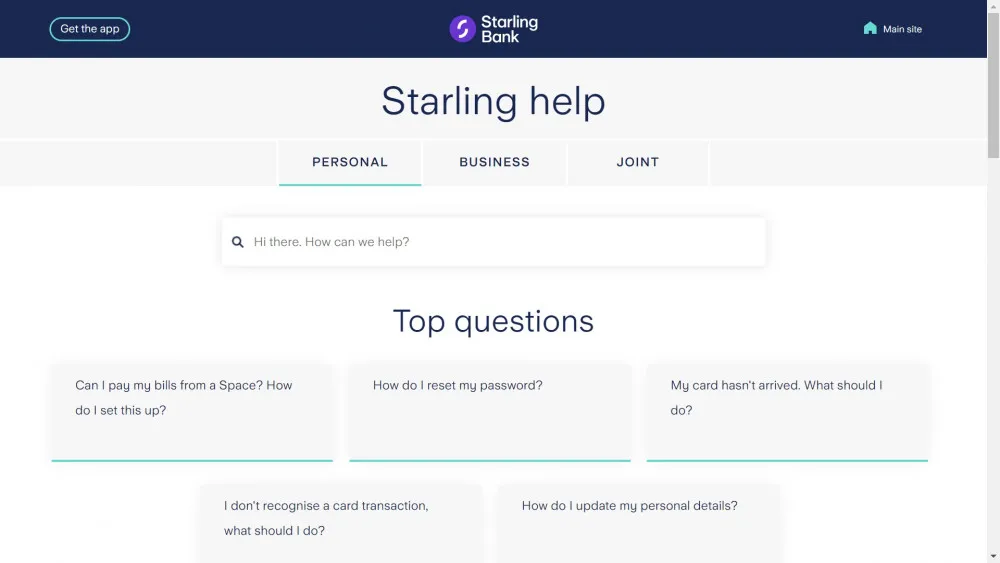

Starling Bank blends innovative customer support technology with human interaction by combining customer service agents and a platform reachable from the app via the in-app chat, email and customer hotlines. Starling Bank guarantees that no chat bots will answer your queries because their customer service is manned by real humans.

Users will find Starling Bank competitive when traveling abroad - in addition to no fees for foreign card payments, you will not be charged for withdrawing cash at ATMs. And you will be able to withdraw up to £300 in foreign currency per day.

All things considered, Starling is highly recommendable to anyone looking for a dependent current account that costs practically nothing, loaded with a set of useful features and offers an excellent mobile experience through its user-friendly interface.

However, for those who prefer In-person customer service or those who transact using a huge amount of cash, the features of Starling might not suit their banking preference, but Staring it is a great supplemental or main account nevertheless.