Intro

Interested to open an account with a digital bank but can't decide between Revolut and Digital International Bank? We've prepared this detailed comparison to help you decide.

Revolut accepts around 40 countries and most of them are in Europe. It also supports US residents and those who are in citizens of Singapore and Japan.

As for Digital International Bank, it currently allows registrations of users from over 150 countries and this makes them a truly global company. It's worth noting that US residents are also included in this list.

If you have a Revolut account, it is capable of accepting up to 18 currencies including USD, GBP, AUD, BGN, CAD, CHF, CZK, DKK, EUR, HKD, HRK, HUF, JPY, NOK, PLN, RON, SEK, and ZAR.

A DIB account on the other hand accepts over 55 currencies. The advantage of having multi-currency is that helps you save on exchange fees since your account is capable of accepting your preferred currency.

Revolut clients can choose to have a card under the Visa or MasterCard brand. With DIB, clients are only given the Visa card.

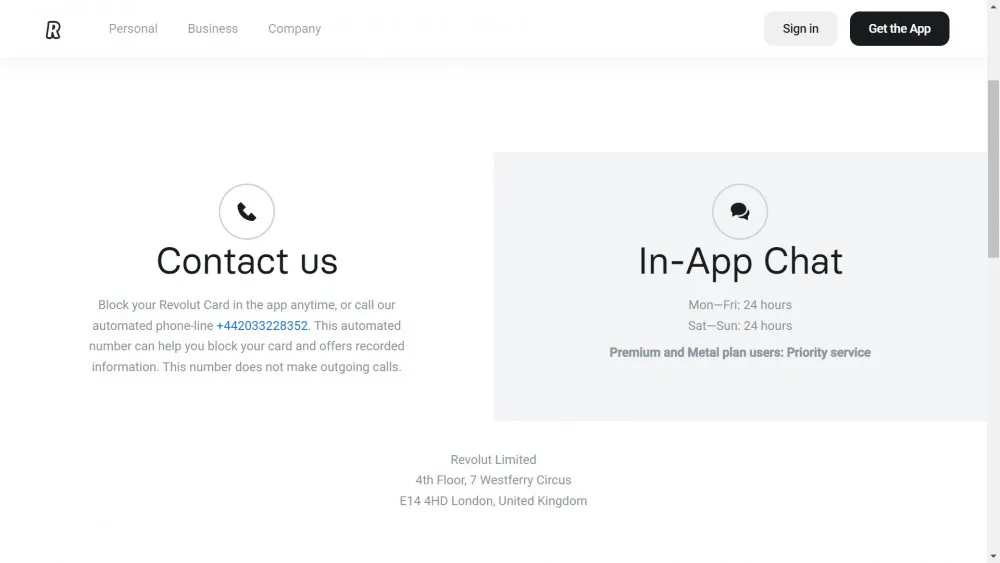

If you have any questions, issues or concerns regarding your account, the only way to contact the Revolut customer support department is either via email or live chat.

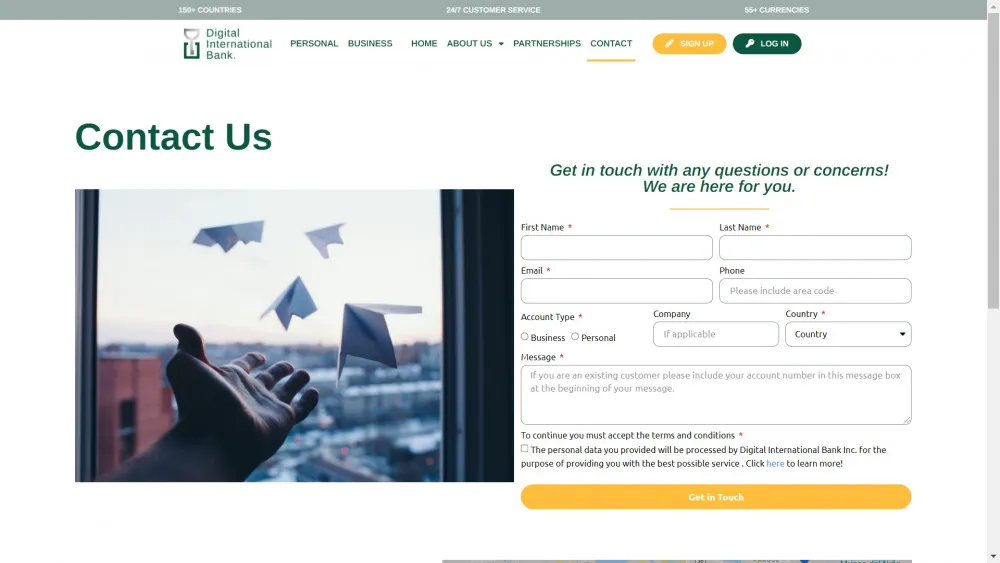

As a DIB client, you can contact their customer service team via phone, email or even video chat. They are given more options to get client assistance via different channels.

Reputation-wise, Revolut has over 20 million clients and is highly popular in the UK. It is widely know for its low and transparent fees and its exchange rates are based on the mid-market exchange rate for foreign transactions although this is not available on weekends.

DIB on the other hand is known for its hybrid banking service. In addition, they are regulated by US federal law and are capable of providing financial services to clients across the globe.

Both Revolut and Digital International Bank are highly established and secure digital banks so you basically have 2 good options. What you have are banks that offer convenience and less expensive alternatives to traditional banks. With Revolut, you'll get to enjoy a one-stop financial resource that comes with a lot of functions while with DIB, you get to enjoy the best of digital and traditional banking via its hybrid service that offers a more personalized experience.