Revolut is a digital bank that is based in the UK. Founded in 2015, this fintech company initially provided a service that is primarily catered for frequent travelers with real interbank exchange rates. It’s currently not a full-fledged bank but rather an e-money institution.

| 🏦 Headquarters | London, UK |

| 📜 License | European Central Bank, Bank of Lithuania |

| 👤 Account | Personal, Business |

| 💳 Card | Visa, MasterCard |

| 📱 App | Android, iOS |

| 💁 Support | Email, Live Chat |

| Operator | Card | Reliability | Best in | Score | |

|---|---|---|---|---|---|

#1

|

Visa, MasterCard | Low and transparent fees with mid-market exchange rates | International Money Transfers | 97 | Open Account |

#2

|

Visa | Online banking with no monthly fees | Spending Account | 96 | Open Account |

#3

|

Visa | Hybrid banking with quality support | Hybrid Banking | 94 | Open Account |

Revolut offers personal and business accounts so you can choose which one is best suited for your needs.

For personal accounts, there are 3 options:

The good news is that opening an account is free and maintaining one doesn’t have any monthly fees unless you want to go for the Premium or Metal subscriptions.

Should you decide to open a personal account, the entire process is fairly simple and easy. All you need to do is just download their app into your phone, enter your mobile number, and set a password.

And just like what most banks do to verify the accounts of their clients, they will also ask you to provide the following details:

Once that is done, you’ll need to make your initial deposit and send them a selfie together with a valid passport for verification.

Keep in mind that if this is your first time to do a selfie verification, don’t worry because this is now a common practice that’s used by most banks and financial organizations for the purpose of verifying the identity of their clients. This will also save you a lot of time since you’ll no longer need to visit a branch anymore.

Opening a bank account with Revolut only takes a few minutes of your time. You can follow the simple procedure below:

If you're interested with the Business account, it won't matter if you have a start-up, small to medium or a large corporation, because this account type is ideal for business of any size. It is available in 28 currencies and even provides an Open API that you can utilize if you're interested to automate your business banking.

Overall, the Revolut Business account comes with a lot of useful tools for your business that you can take advantage of so you can have much more control over your finances.

Even if you're based in the UK, there's really no need for you to visit their headquarters in London since you'll be able to manage your account and make financial transactions online straight from your phone.

Also keep in mind that Revolut UK has a banking license but still operates as an e-money provider (fintech) rather than a full-fledged bank in the United Kingdom.

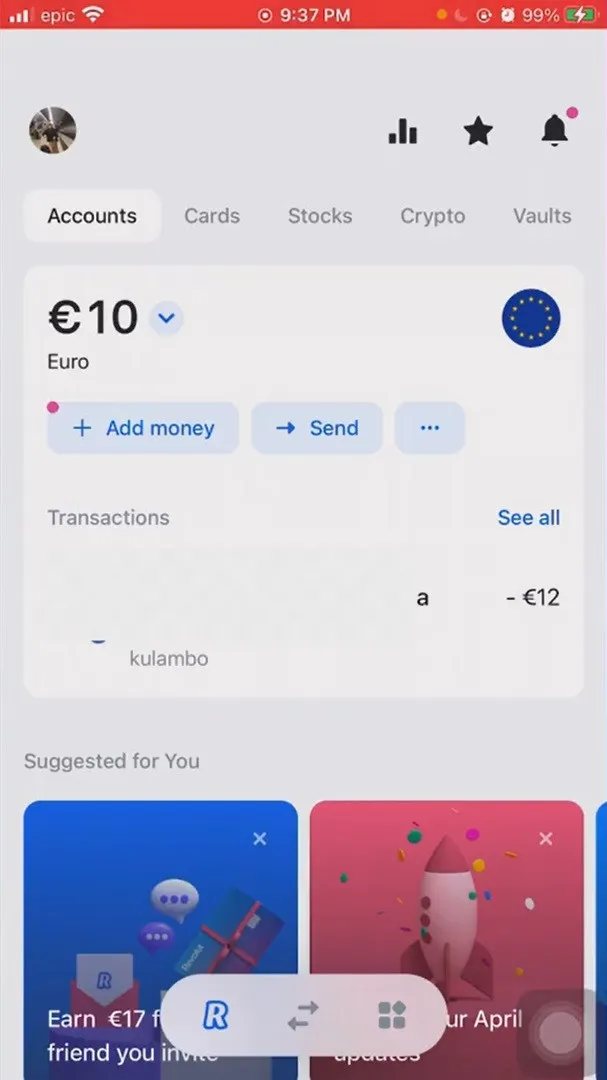

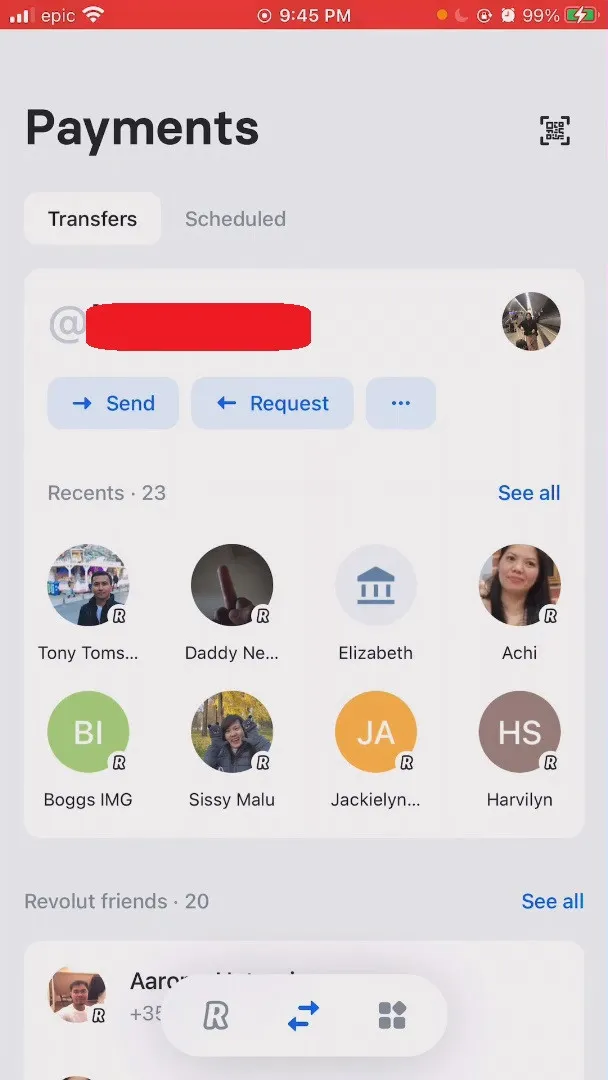

Regardless if you're going to access your Revolut account on the web or via the mobile app, the interface is very much the same. The buttons and links are easy to understand and there's no chance that you won't get confused as it is very user-friendly. Even first-timers won't have a hard time getting used to their platforms.

Via the dashboard, you'll be able to access the main features and services of this bank:

And just like most banks, you'll be able to see a preview of your current balance so there's no need to access any menus just to see how much money you have in your account.

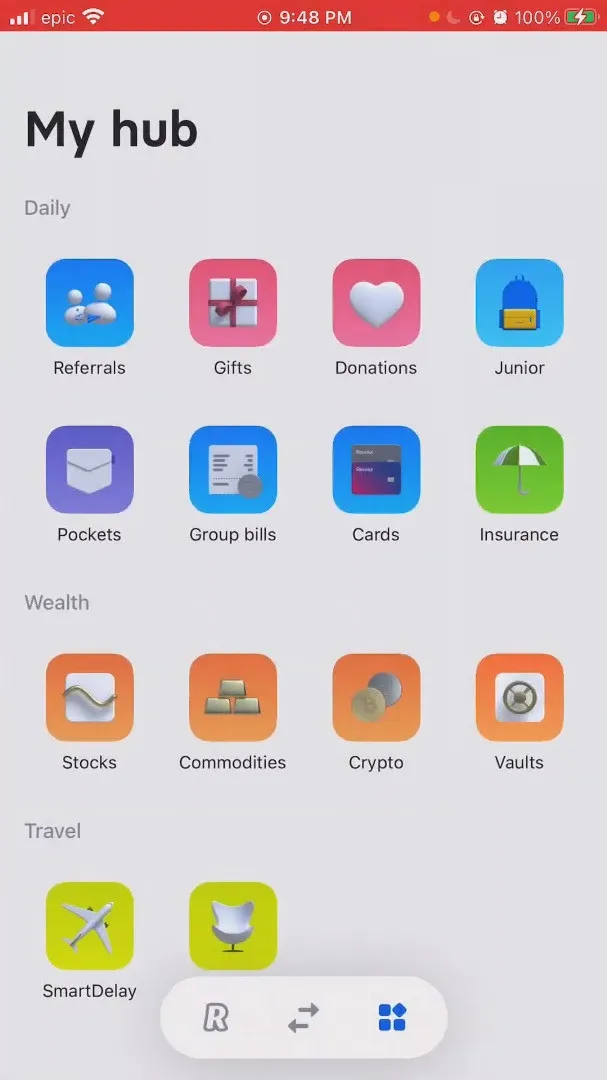

There's also a "My hub" section where you can get an organized menu of several services that you can use from this digital bank. It's a pretty cool feature of the Revolut app that you can use especially if you have lots of banking activities.

In order to access your account, you'll need to use the mobile number that you registered and your personal passcode. These 2 important details are required to view and manage your account via any of their mobile app or directly through their website.

Another alternative that you can use to login via their mobile app is using the face recognition or fingerprint ID, depending on the security features of the mobile device you are using. This makes your Revolut login experience much easier and more secure since there's no need to always remember your passcode.

As we mentioned earlier, Revolut is not a full-fledged bank yet but that doesn’t mean that you won’t be able to enjoy the services that you’d normally get with a real bank. In fact, Revolut has several banking features that can match with what a high street bank is offering:

While it’s worth mentioning that Revolut’s services are mostly free, it’s important to know that some features come with specific fees.

Even if you’re going to get the free plan, keep in mind that there are still some fees that you need to pay if you want to avail some of their services.

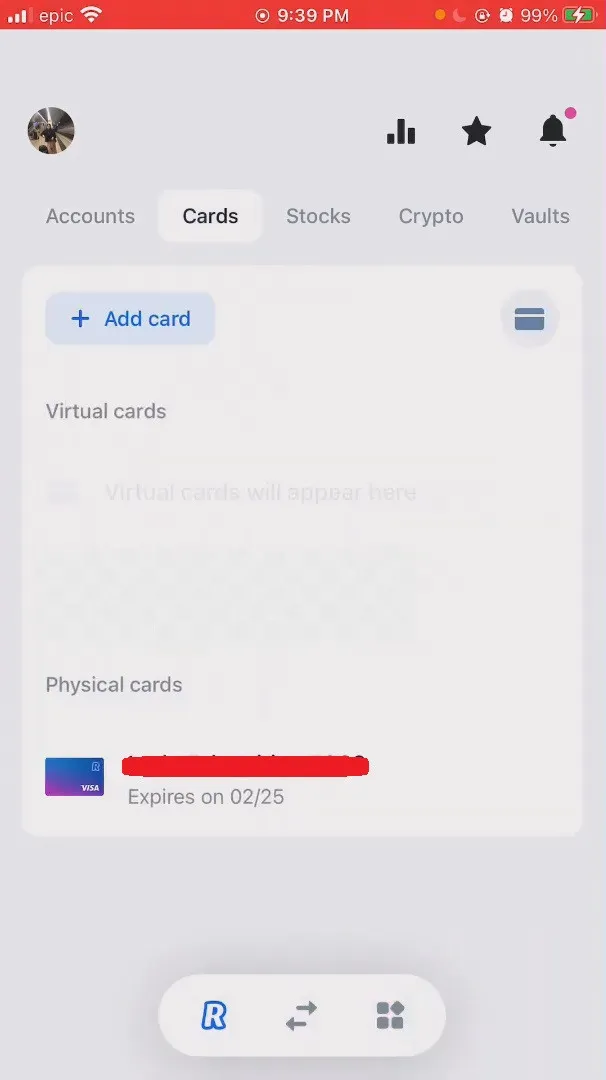

For example, if you want to have a physical card and have it delivered to your address, then it will cost you £4.99. This fee is however is waived if you have a premium account.

ATM withdrawals are also free but keep in mind that this is only limited to a monthly cap of £200. If you exceed that amount on the same month then every transaction will incur a 2% extra charge.

When it comes to currency exchange, Revolut’s rates are on the competitive side since their buy and sell prices are based on market rates. Do take note though that you can only exchange currencies for free with a maximum monthly total amount of £1,000 and this is only applicable on weekdays. Anything beyond that will cost you a 0.5% charge.

Signing-up for an account with Revolut already makes you eligible to avail their Visa card. This card can be linked to the mobile app and it can be very handy for buying items in over 110 countries with real-time interbank exchange rates.

You can also use the Revolut card to withdraw money in several countries and what's notable is that it supports over 140 currencies and has no hidden fees so you won't end up getting any surprise charges.

Revolut offers personal loans ranging from which can range from €1000 to €25000. Keep in mind that the amount that you can borrow will depend on your current credit rating and that you won't be asked for any sort of security in exchange of this loan.

In addition, getting a loan doesn't come with any fees except for the interest of course which will be shown to you upon your application.

You can apply for a personal loan directly the app via the Credit menu where you will need to answer a few questions.

Take note: Personal loans are only available to specific countries including Lithuania and Poland.

We can’t emphasize enough:

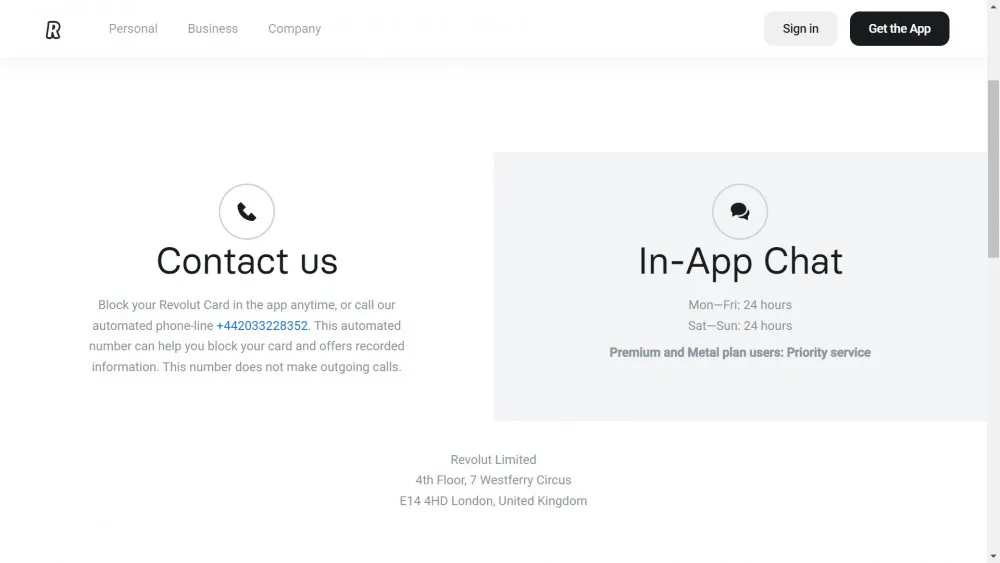

Whether they’re providing their services online or offline, customer support should remain as one of the bank’s top priorities. They should always be available and must be reachable via the most common methods of communication. Otherwise, you better look for another bank that’s much more reliable.

You have the choice of contacting the Revolut customer service team via live chat or email. Although phone support is technically available, this option can only be used for the purpose of blocking your card and nothing else. It’s an automated system anyway so don’t expect to have a conversation with a real person over the phone.

For most issues, the live chat is the best way to get in touch with a live agent. If you don’t have an immediate concern or just have some questions then the email support might be your best option especially if there’s a long queue on the live chat.

What Revolut offers is a nice alternative to the traditional way of banking. Their app is well-designed for a great digital banking experience, and is in fact, one the best ones that we’ve tested so far in terms of user-friendliness and usability.

Being able to make transactions using multiple currencies is no doubt an attractive benefit especially if you’re a digital nomad or just a frequent international traveler who’s looking for a hassle-free way to secure a bank account. You have the choice of opening an account for free, or choose the premium one if you want to enjoy more perks.

The only minor downside is that they don’t provide phone support but you can easily get help and assistance through the live chat feature or even via email. Overall, Revolut is a great choice if you’re regularly on the move or simply looking for a digital bank that offers decent banking products.

Overall, Revolut is a great choice if you’re regularly on the move or simply looking for a digital bank that offers decent banking products.