PayPal is a giant e-commerce company that is based in San Jose, California, USA. Founded in December 1998, it facilitates payments through online transfer and uses a secure online account to let you pay or receive payment from items sold online, services rendered or even by tipping or lending money.

Additionally, by linking your bank account, credit card or debit card information listed on your PayPal account, you can select the account or card from which payments will be made.

Did you know that digital banking offers many benefits and this includes the convenience of being able to transact from anywhere? If you're interested in opening an account with a digital bank, then here are the top 3 names in the industry to consider:

| Operator | Card | Reliability | Best in | Score | |

|---|---|---|---|---|---|

#1

|

Visa, MasterCard | Low and transparent fees with mid-market exchange rates | International Money Transfers | 97 | Open Account |

#2

|

Visa | Online banking with no monthly fees | Spending Account | 96 | Open Account |

#3

|

Visa | Hybrid banking with quality support | Hybrid Banking | 94 | Open Account |

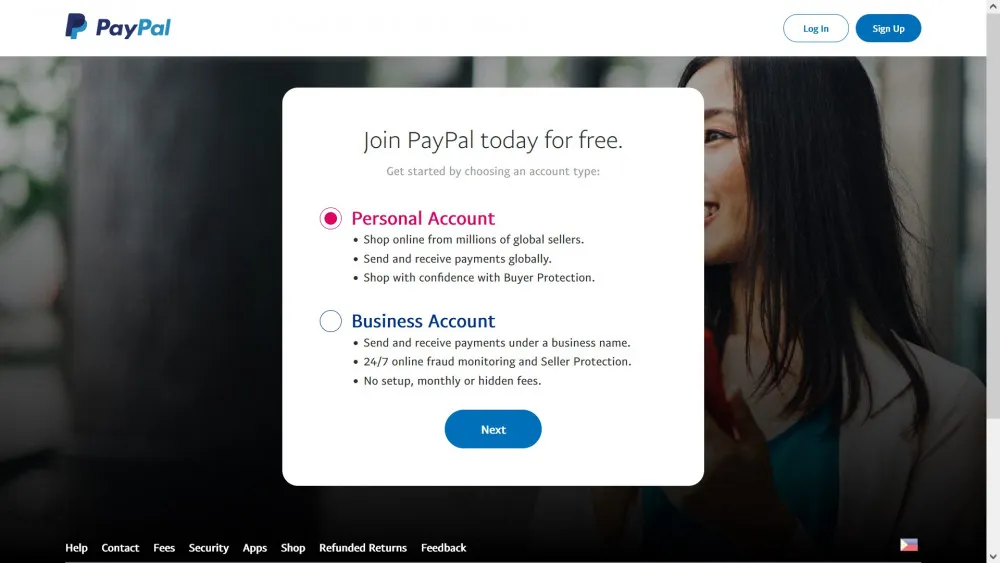

This digital payments company only offers 2 types of accounts: Personal and Business. Let's take a quick look at its features so you can determine which PayPal account is right for your needs:

This type of account is ideal to use if you’re planning to use their service mainly for the following.

Simply say: The Personal account is for individual purposes and for your own own use. If your activities are mostly for personal transactions and not any business-related matters, then this is ideal account to use.

As the name implies, this account type is suitable if you're running a business and you'd like to send or receive payments using a business name rather than your own name. This is also best to use to keep your business funds separated from your own personal funds.

This will also allow you to electronically send out an invoice to your client's email address for the products you sold or services that you rendered, and they can pay it directly via the payment button or link on that invoice.

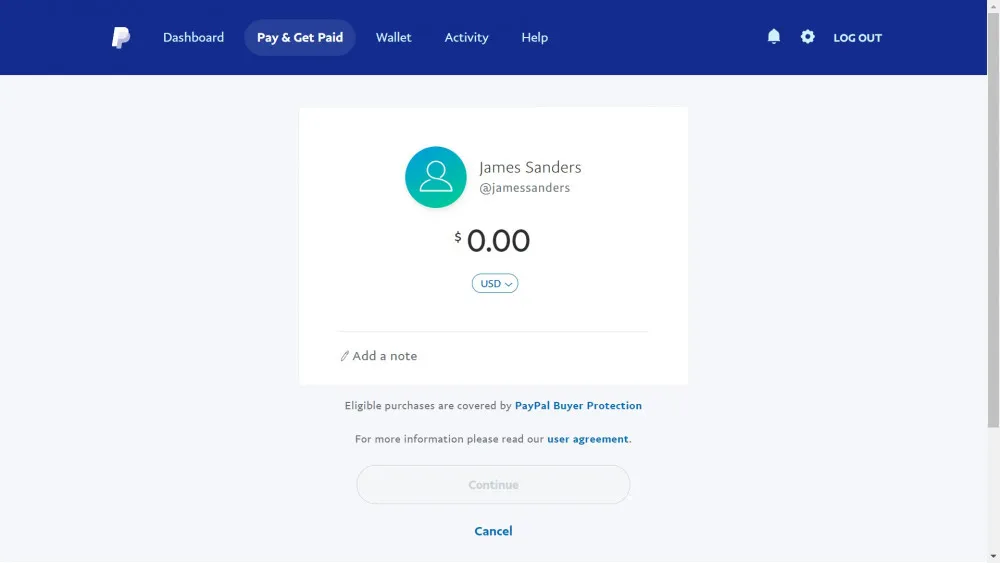

If you want to register for an account with PayPal, follow the basic steps below:

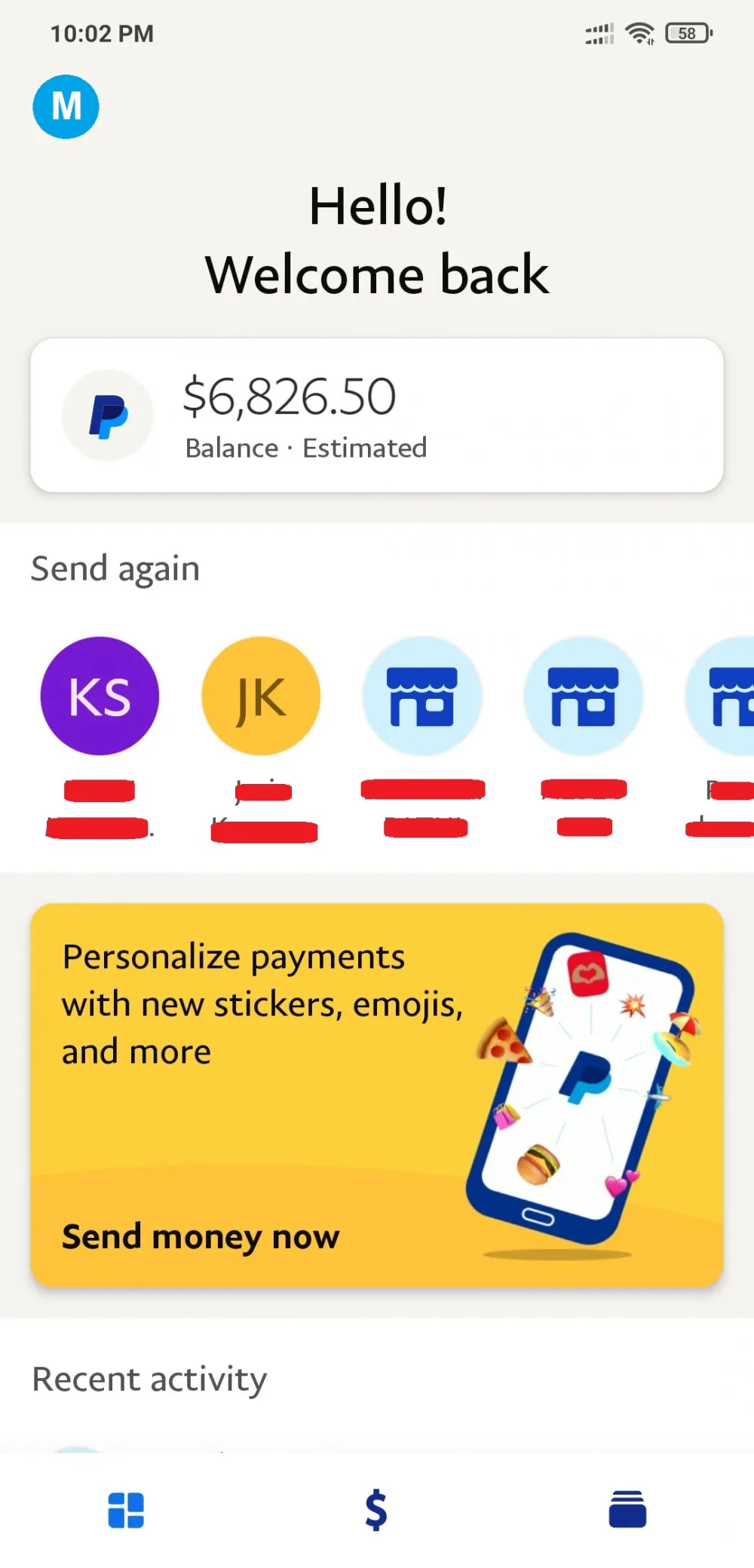

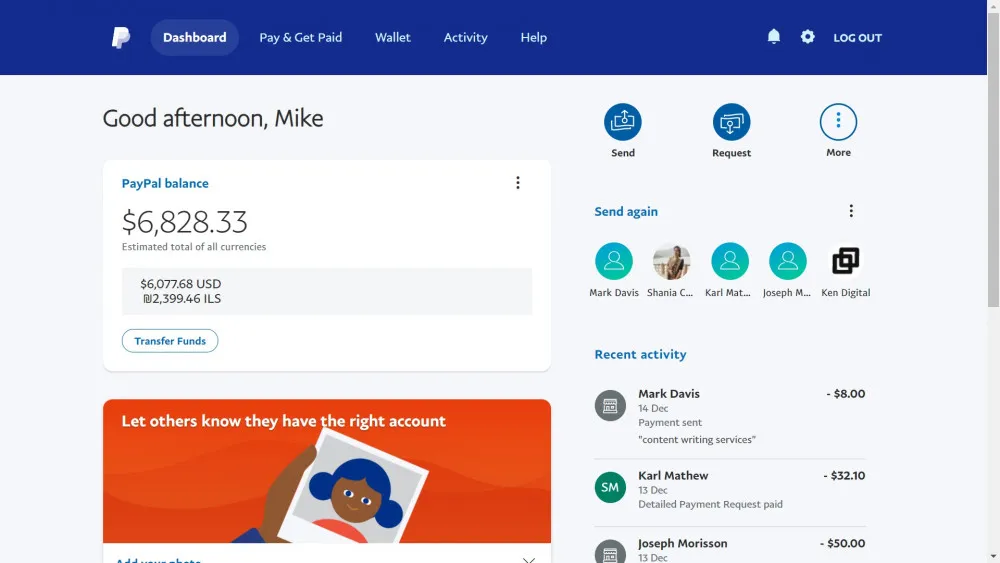

Compared to other digital wallets, PayPal's apps are very straightforward and don't have that much eye candy. It's really simple and is very much like the standard interface of an iOS or Android menu so it's really not that hard to get used to the looks and feel of it.

Via the mobile website and the app, the menu is placed at the bottom where you can only see 3 icons. On the mobile website, the menu will show the first 2 icons for sending and requesting money and the 3rd is the icon for showing more options where you can create a detailed payment request, create an estimate, or go to the Resolution Center. The mobile app's icons are different, with the first icon being dedicated for the dashboard, the second icon for payments, and the third icon for accessing the Wallet, Rewards and Activity sections.

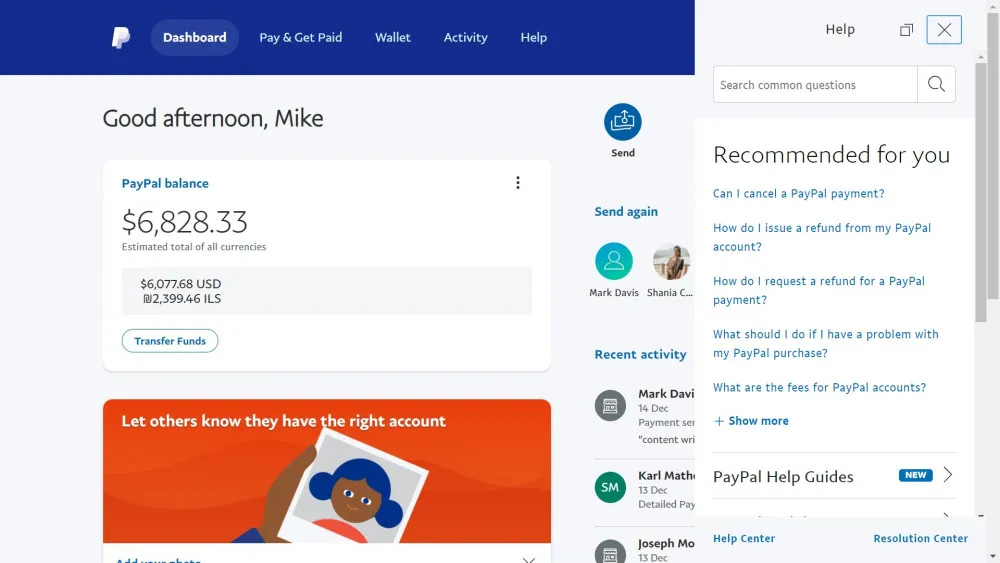

The web-based version is very much similar to the app's design so you certainly won't get lost should you decide to switch from one platform to another. The only difference with the web-based interface is that you'll be able to get a much more organized dashboard where you'll have quick preview of your account including the current balance, the latest contacts that you made transactions with, and a summary of your recent activities.

The top menu also lists more features and this includes the following:

Overall, we found the PayPal app to be very intuitive with plenty of features and we're rating it as better than average.

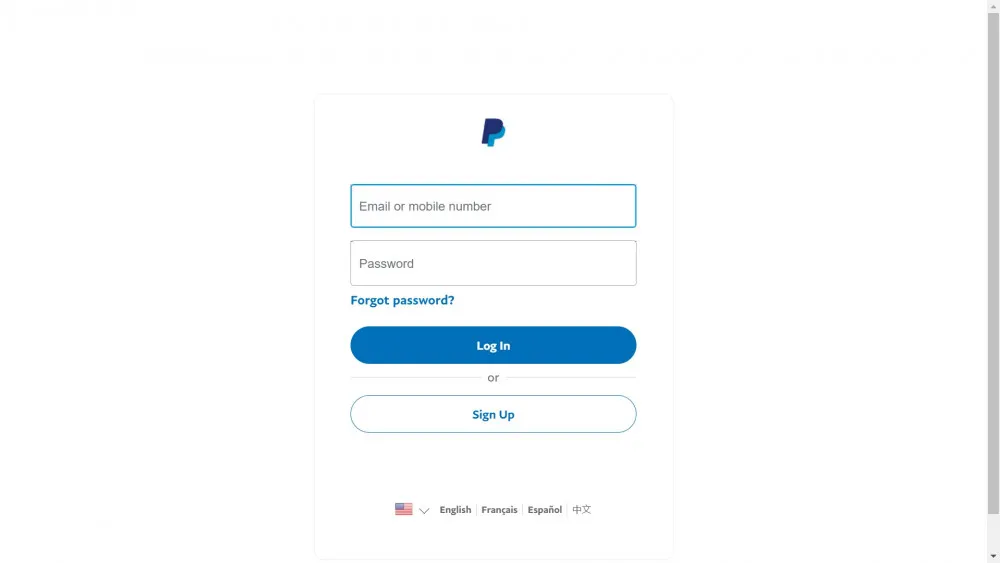

Logging in to your PayPal account will only require the email address or a mobile number that you linked to this account, and your password. It's also important for you to remember your PayPal login credentials because there are no other details that you can use to sign-in. Otherwise, you will need to reset your password or contact their customer support department for assistance.

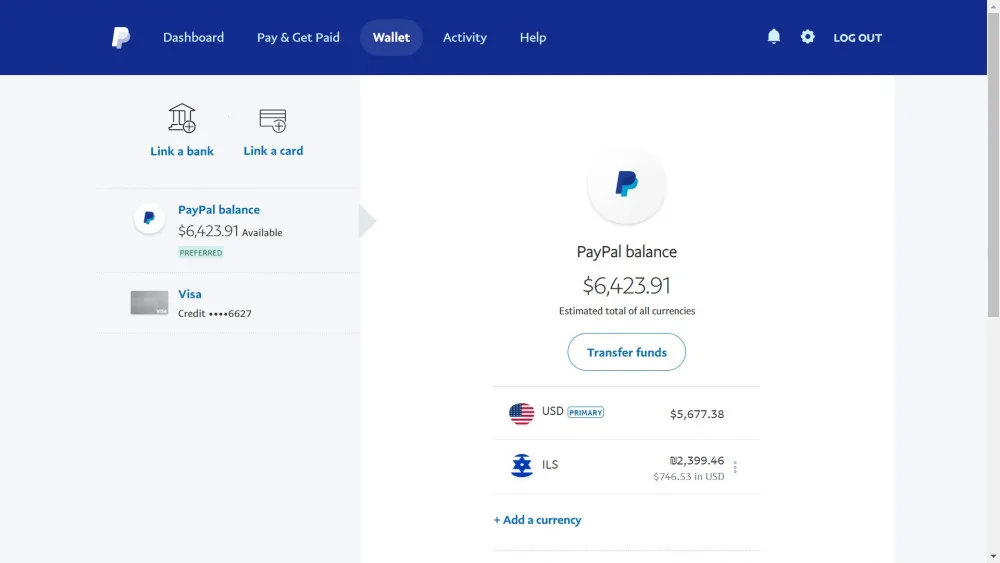

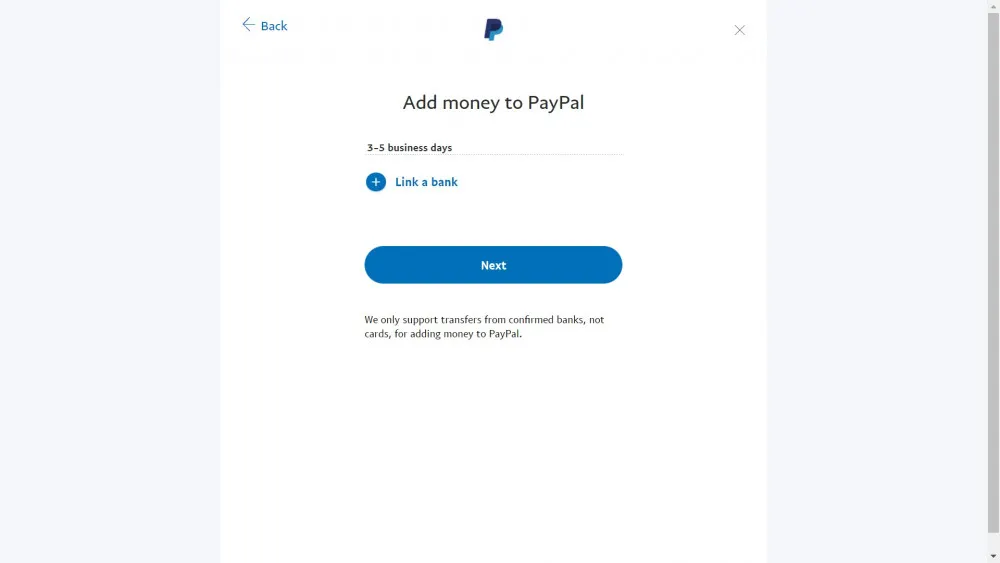

PayPal's wallet features are pretty much very basic. You can do the very simplest functions of adding funds to your wallet and transferring funds from your wallet to another account or to a third party account.

When you access the Wallet page, you'll be able to see all the actions you can do including viewing your PayPal balance, viewing the currently linked accounts, linking a bank account, linking a credit card, transferring funds and adding a currency.

In general, it has the most basic features of a digital wallet although a few more value-added features would have made it a lot better, given that PayPal is such a huge name in the digital wallet industry.

PayPal has a reusable credit line called PayPal credit which can be used for payments on purchases. You'll have the option to pay for it instantly or pay it later.

Simply say: It's basically like having a credit card, so when you get approved to use this service, your approved credit line will be primary based on your creditworthiness so be sure that you have a good credit standing..

Here's the deal: Regardless if you decide to open a Personal or Business account, you won't get charged by PayPal to open or maintain one. That alone is a great advantage since you won't have to pay any monthly or annual premium.

If you are from the US, you won't incur charges for sending money to friends or family members as long as you are using your bank account or PayPal balance or even a combination of funds from any of the 2. You will only incur a charge if you're going to send personal payments via your credit or debit card.

As a receiver, you will also not incur any fees as well if you're getting the funds from friends or family members in the US.

As for payments of services or purchasing goods, you won't get charged but if you're the one to get paid for providing goods or services, then you will be charged with a fee.

In addition, fees also apply for sending international payments or payments sent to other PayPal users who are based in a different country. If you're the one to receive payments from a user from another country, you will also get charged for the transaction.

Lastly, withdrawing funds from your PayPal account and transferring it to a bank account is also free. You will only incur a charge if you want a check to be issued under your name.

For any issues or account concerns, PayPal's website and app provides a lot of options for you to resolve them on your own or via assistance from their useful guides, advanced bots or friendly support agents.

There's a Help menu that you can quickly access straight from the main dashboard and this will launch a sidebar where you can search for the most common questions or look into the recommended articles which might help you with your issues or concerns. It's a very nice tool which serves as an instant access for answers to most commonly asked questions but if you believe that you won't be able to resolve your issue here, then going to the Resolution Center is the next best step to take.

Here's what you need to know:

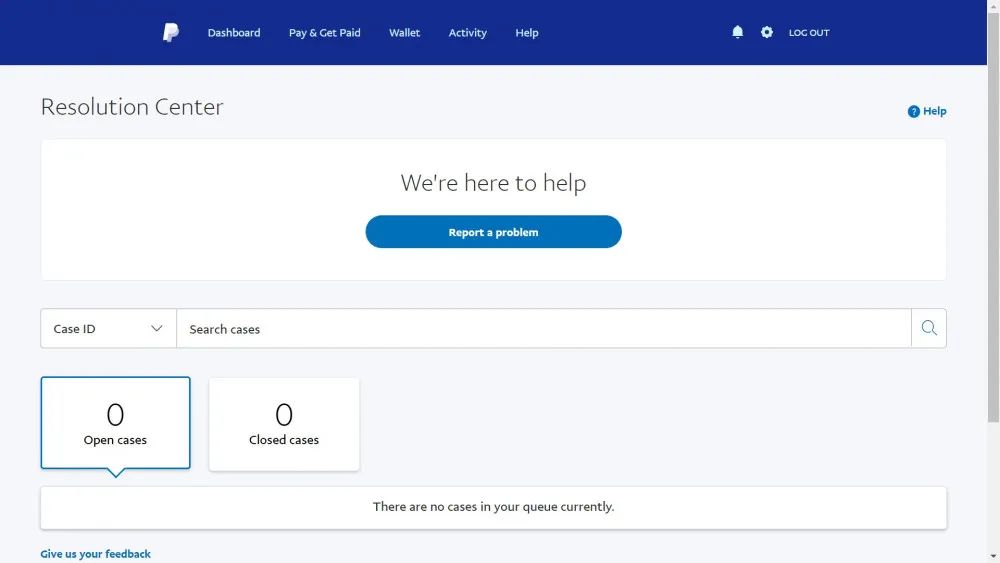

The Resolution Center can be accessed by clicking on its direct link from the Help sidebar. Via this page, you can report any problem you encountered.

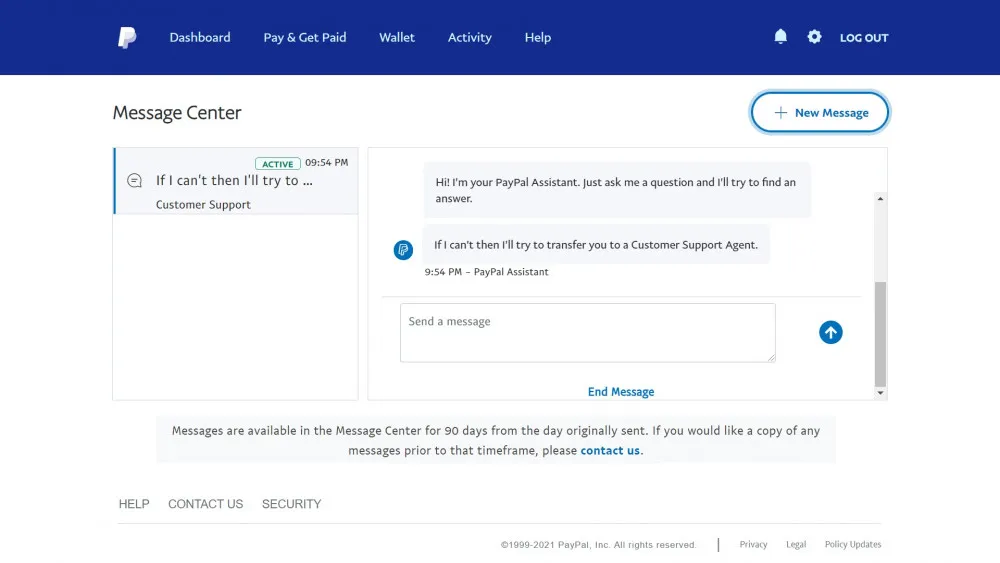

In addition, there's also the PayPal Assistant which is not actually a live chat agent but more of a chatbot that will try to solve your common question. We've noticed that for the most basic issues, you can interact with this feature to get it resolved but for other matters that would need real human assistance, getting in touch with an agent is the best option.

In order to do this, you'll need to enter "How can I talk to someone at PayPal?" on the chat window and you will then be asked if you'd want to forward the conversation to a customer support agent. This will also show you the estimated waiting time.

Keep in mind though that this estimation is really not that accurate. We were advised that it will only take 10 minutes to get a live agent but it actually took around 20 minutes before we were able get in touch them.

In general, you already have plenty of choices to take care of issues if you feel like doing it on your own, or you can simply get in touch with them directly if you'll need some help or assistance from PayPal customer service agents.

We've realized that the Help menu and the PayPal Assistant is very handy for basic issues but for more serious or complicated matters, a conversation with a real person is still the best option.

What makes PayPal a fantastic choice is that they have a digital wallet platform that is very user-friendly and simple for both consumers and businesses.

Their fees are reasonable but the fact that you don't need to pay for a premium to maintain your subscription is already an advantage. Still, watch out for the conversion fees if you plan to exchange your funds into a different currency because it's a bit on the high side.

As for customer support, you have plenty of ways to resolve things on your own thanks to the Help menu but if you want their agents to take care of the issue then using the Resolution Center or getting in touch with them directly is the next best action to take. They do need to improve on the waiting time though because it could take more than 20 minutes to get in touch with an agent.

Overall, this is a great digital wallet service that is secured and safe and there's no question why they are generally accepted worldwide.