N26 is a mobile digital bank that started its operations in 2013 and is based in Europe. This fintech (a portmanteau of finance and technology) company aims to remove the complex banking system by providing an efficient and quick way of managing funds. It fully operates as a bank, officially receiving its banking license from the European Central Bank last 2016.

| Operator | Card | Reliability | Best in | Score | |

|---|---|---|---|---|---|

#1

|

Visa, MasterCard | Low and transparent fees with mid-market exchange rates | International Money Transfers | 97 | Open Account |

#2

|

Visa | Online banking with no monthly fees | Spending Account | 96 | Open Account |

#3

|

Visa | Hybrid banking with quality support | Hybrid Banking | 94 | Open Account |

N26 offers personal and business accounts and both account types offer the following plans:

Each plan has its own perks with the Standard plan being the most basic one and the most preferred since it doesn’t have a monthly subscription fee. Still, it would be best to compare each plan to determine which one is the most suitable for your banking needs. The Smart plan for example has extra features such as an optional credit card, maximum of 5 free withdrawals, shared sub-accounts, round-ups, phone support and more.

Since the Metal plan has the highest premium, it has the best benefits that are worth considering such as free ATM withdrawals in any country, various insurance products (medical travel, trip, flight and even a pandemic travel coverage), priority hotline and many more. If you’re a frequent traveler and you’ll be able to use these perks then the €16.90 monthly fee is actually quite a good deal.

N26 does not charge monthly fees such as ATM withdrawals (for 3 months if you are using a regular account) or foreign transaction fees to your selected accounts when using the same currency (Euro). Moreover, it has collaborated with Wise, a mobile application, for foreign transactions and different currencies.

As of this writing, they support the following European countries:

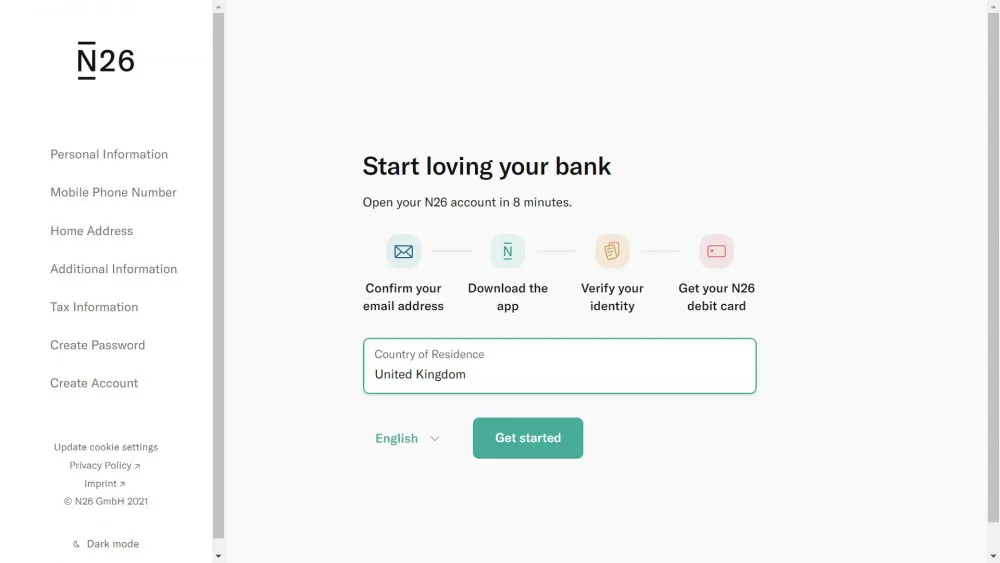

Should you plan to open an N26 account, the entire signup process is pretty straightforward. All you need to do is download the application, input the necessary details that the application requires, select a plan, prove your identity by uploading a picture (or other methods depending on your nationality), and choose a payment method to finance your card.

Note: Since you won't be required to go to a physical branch to verify your account, you need to make sure that you have submitted all the correct details and clear photos that they will ask from you. Any discrepancies could affect your full verification status be sure to double check everything before sending any information or documents.

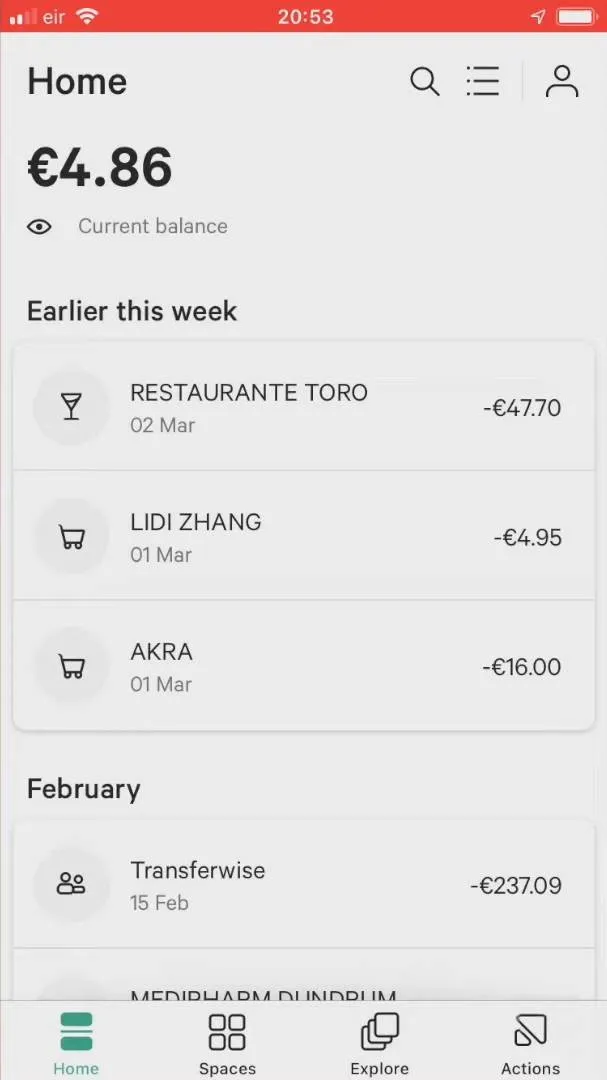

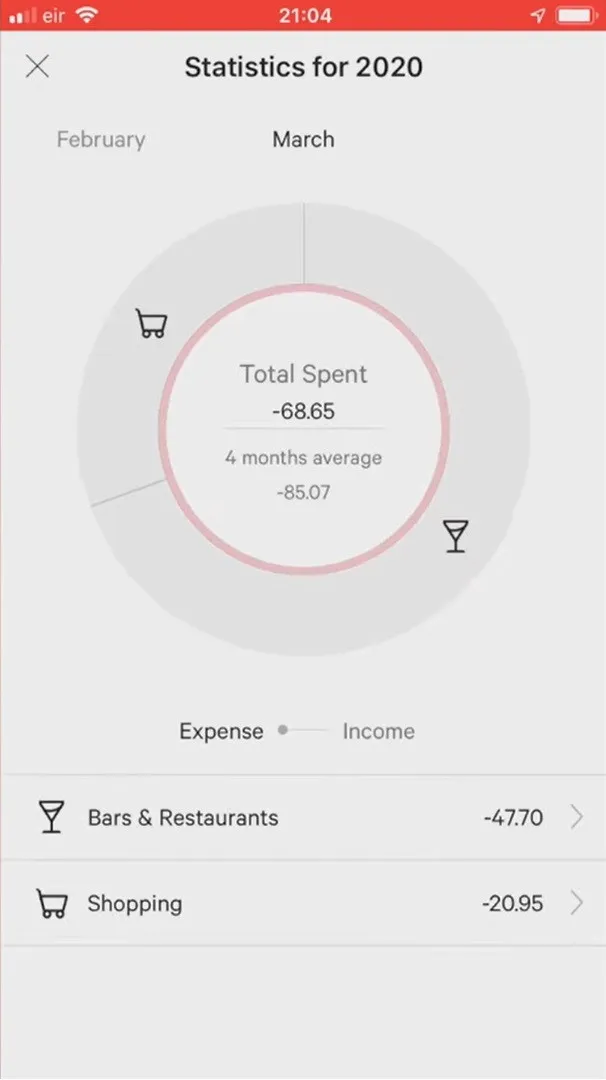

The N26 app optimized their Home section, ensuring that all features are readily accessible in one place. From navigating through the app from the Home section, which displays all details and features, to important tabs for significant purposes like Action, Cards, and Space tabs, these were all made clear and easy to use.

For example, the enhanced Actions tab is more user-friendly with intelligent features to help you make bank transfers, view payments, search the nearest ATM booths, or customize the app settings according to your preferences.

It's also worth mentioning that the app continues to improve with their regular updates. We've noticed that a lot of optimizations were made within just a few months of using it so it goes to show that they constantly make improvements and that is definitely an advantage.

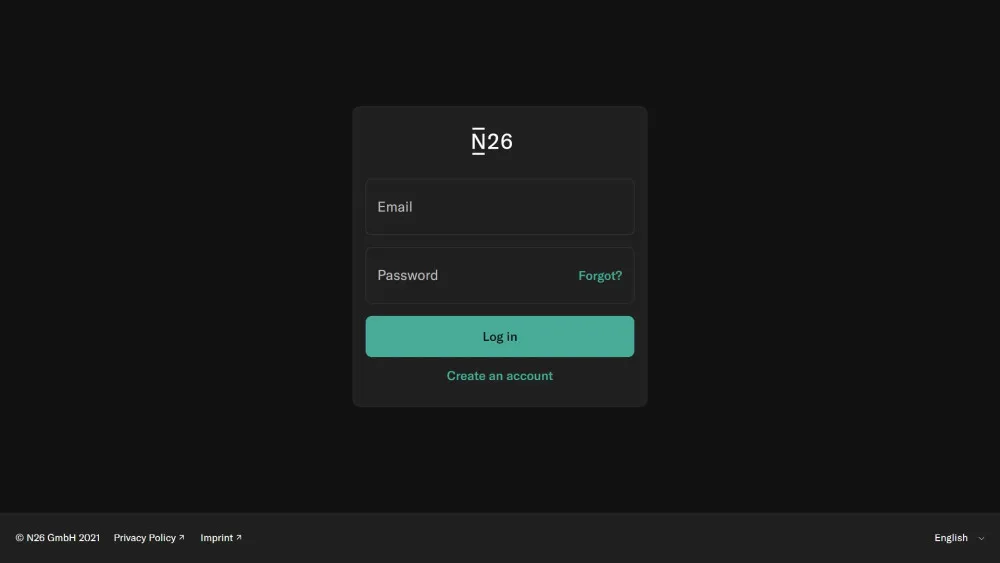

Both their website and app automatically adjusts the interface into dark mode if it detects the computer or device to have turned on this feature. This is a very nice feature since your eyes won't get strained.

The N26 app also has distinct features depending on your operating system. For example, if you're using an iOS device such an iPhone or iPad, you'll enjoy N26 widgets for easier and faster navigation. Now, if you're device is powered by Google's Android mobile operating system then you can take advantage of the QR code scanning features for quick bank transfers.

To login into your account, you will need a registered email and a password which must be accomplished during the registration process. If you're not keen on always remembering your login details, you can opt for using biometrics identification using FaceID and fingerprint scanning as a way to access your account.

In general, these N26 login methods will give you flexible options to view and manage your account safely.

N26 offers convenience to people who reside in Germany, Italy, Austria and other supported European countries by providing the following features:

However, despite its robust features, it lacks some popular features among its competitors, such as the availability of joint accounts.

Opening an N26 standard account is free so you don't have to worry about getting maintenance and monthly charges during your billing month. Additionally, when you open the Standard account, you'll be given a free virtual card but if you want a physical one, then you can order it for €10.

N26 gives several free ATM withdrawals per month for their clients who are in the Eurozone. The Standard account has strictly 3 free withdrawals; otherwise, an additional fee of €2 will be charged. This rule is also applicable to other accounts like the N26 Smart and N26 Metal.

Furthermore, foreign ATM withdrawals will be charged 1.7% of the total amount you withdraw when using the Standard and Smart N26 accounts. Banks or card companies also charge foreign transaction processing fees for providing international services. However, these charges are waived when using its premium bank account, the N26 Metal.

In addition, money transfer with the same currency offers no charge with them but in the case of international transfers, you need to pay only the foreign exchange fee of 0.35% - 2.85% depending on the currency via Wise, their money transfer partner.

Upon signing-up for an account, you can also avail their MasterCard debit card that comes with a number of features such as contactless NFC technology. Since MasterCard is a known brand, you'll be able to use it for making over-the-counter payments, online shopping and even withdrawals while you're abroad.

Overall, the N26 card can be a very handy for day-to-day transactions or any instances where you'll need money for quick payments.

N26 offers loans ranging from €1000 to €25000, and you can provide your electronic signature and get paid directly into your N26 account. Their mobile bank app allows you to make money or avail of loans on your terms. In addition, it also has the feature of a loan payment calculator, which will enable you to compare loans and manage your payment terms ranging from 6 to 60 months.

How does it work?

Your loan will be calculated on this app based on your overall profile—monthly income, expenses, and credit history. Additionally, it will let you decide what's the most suitable for you without any binding offers. You will have the chance to get an overview of your monthly payments, which depends on your selected payment period between 6 to 60 months. You'll immediately get the effective annual rate at the end of the credit checking and how much the credit line will cost.

After further reviews and electronic signatures, you can track your finances digitally. For all of that, whether your loan is provided through aux money credit (a marketplace where private investors invest in approved borrowers) or N26, you will directly be paid into your N26 account. You will then get the loan offer in just a few minutes without any requirements.

Here's what you need to know:

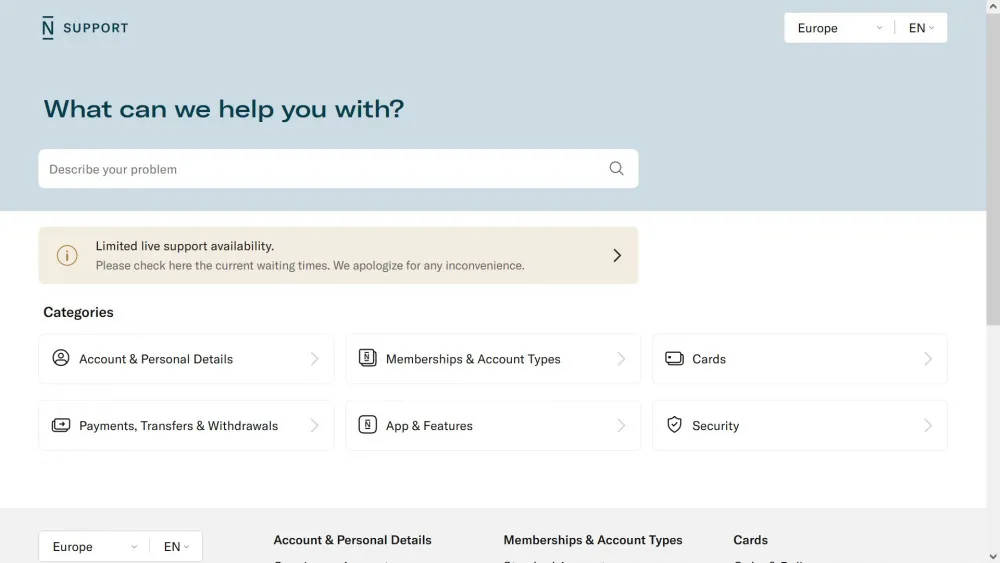

As the banking industry grows, so does the importance of customer support. Efficiency and prompt customer service are critical in the banking industry because they help customers like you avoid confusion and identify a specific problem. It also shows that they value your time and are willing to assist you by responding quickly and efficiently to your queries.

What's great about N26's support team is that they try their best to make your banking experience as smooth as possible with their services. Customer service is always available to help with any problems, such as when an ATM swallows your card, if you cannot access your account, or if you have been the victim of identity theft.

N26 is constantly striving to improve the quality of its customer service. You can contact them via chat, email, phone, and social media. Depending on the country where your account is registered, you may have to wait longer or shorter periods.

We tried reaching them through chat more than once and during the first time; it took 5 minutes for a representative to respond. The second time took 20 minutes for someone to assist us. Email support is okay unless you're expecting a quick reply or answer because it could take days before you can receive a response for email correspondence. If you really need to speak to someone over the phone and you're subscribed to the Standard plan, you will need to reach the live chat first to request for a callback if. The direct hotline is only available for You and Smart subscribers while the priority hotline can only be used by Metal plan holders.

In general, you have plenty of ways to get in touch with the N26 customer service department but if you need a speedy response, we've found that live chat is the best option.

N26 is a popular mobile banking application in Europe, particularly Germany, Italy, and Austria. It offers personal and business accounts that can be accessed using four different plans to satisfy your banking needs. Each plan has distinct advantages and benefits; however, the most expensive plan allows users to enjoy more extensive services by fair means. It's suitable for day-to-day banking although it doesn't provide many investment possibilities.

And if in case you need assistance with regards to your account or have some issues, concerns or questions, N26 can provide you with customer support across different channels. Phone support is possible but their hotlines are only available if you're paying the premium. Still, the live chat is a great alternative if you're on the basic plan.

So if you're seeking for a reliable mobile app that can meet all of your banking essentials while in Europe then you may want to consider N26 as your go-to bank for convenience and safety of your funds.