STICPAY is an e-wallet service provider that is based in London, UK. It was founded in 2017 and since then, its products has been used primarily for money deposits, transfers, and withdrawals.

If you're looking for a detailed review of this brand, then be sure to check out our test results to find out if this e-wallet is right for you.

Did you know that digital banking offers many benefits and this includes the convenience of being able to transact from anywhere? If you're interested in opening an account with a digital bank, then here are the top 3 names in the industry to consider:

| Operator | Card | Reliability | Best in | Score | |

|---|---|---|---|---|---|

#1

|

Visa, MasterCard | Low and transparent fees with mid-market exchange rates | International Money Transfers | 97 | Open Account |

#2

|

Visa | Online banking with no monthly fees | Spending Account | 96 | Open Account |

#3

|

Visa | Hybrid banking with quality support | Hybrid Banking | 94 | Open Account |

STICPAY offers personal and merchant accounts. If you're the type of user who would use it for your own transactions and expenses, then the personal account is the best one to use.

On the other hand, if you're running a business and planning to use their service for payments and transactions, then the merchant account is the better option.

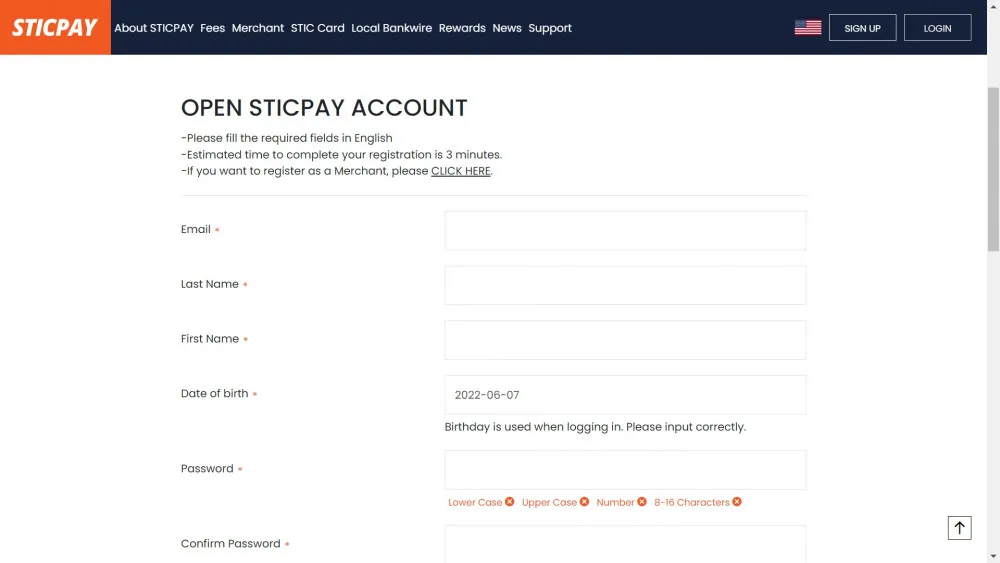

The image below is how the personal account registration page looks like. Take note that the merchant account registration page version is different.

In order to sign-up for an account, you will need to provide the following details:

Take note: You will also be asked to agree to their terms which we recommend that you thoroughly read and check before signing-up. After that, you'll also need to manually sign on the registration form so it might be best to use a tablet or a smartphone with a large screen so you can place your signature. If you're used to doing this using a desktop or laptop via your mouse then this would be great.

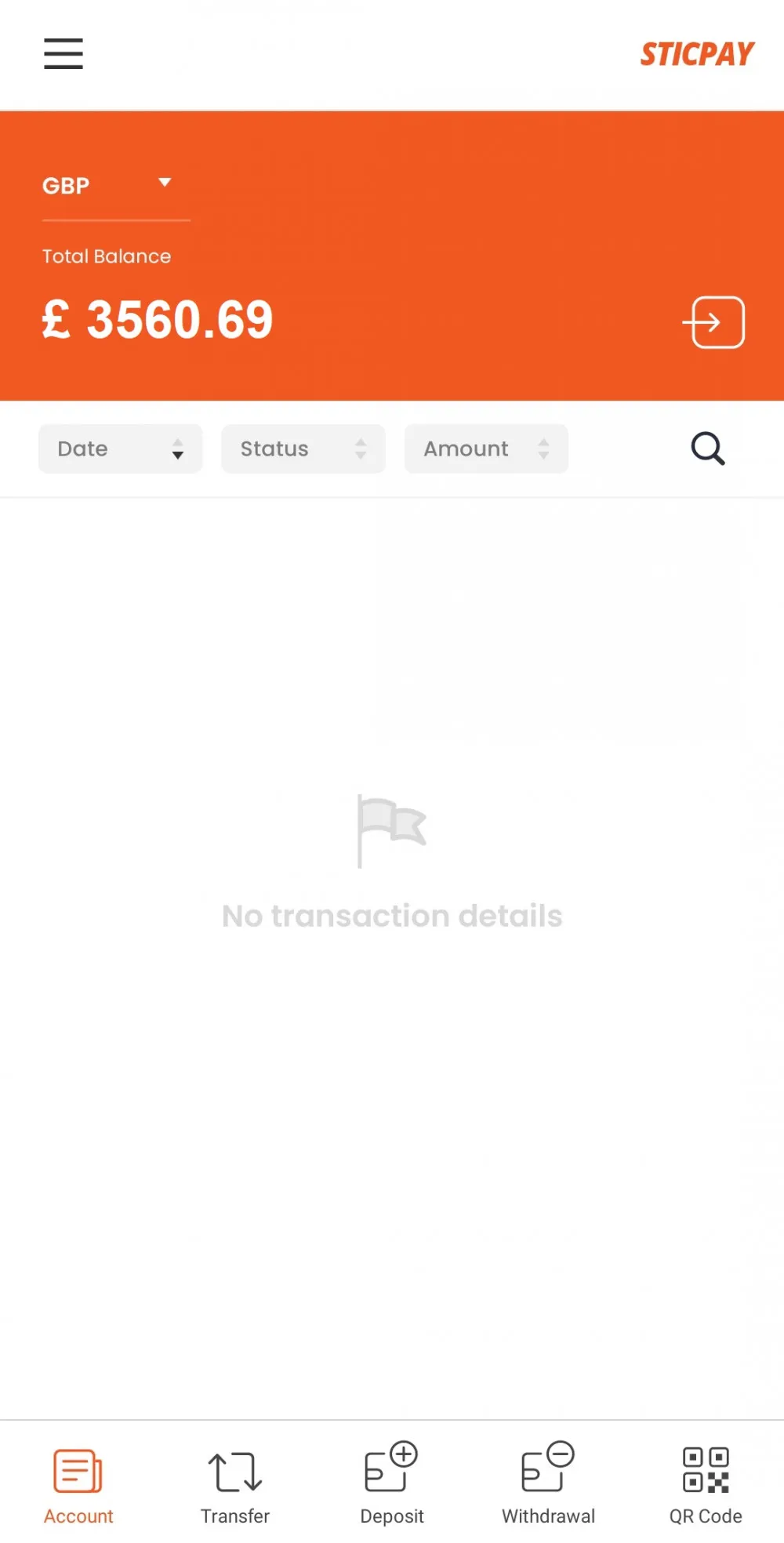

STICPAY has mobile apps for devices that are powered by iOS and Android. The installation process is as easy as any app that you'll download and install on your mobile device.

The app has 5 icons at the bottom of the main user interface:

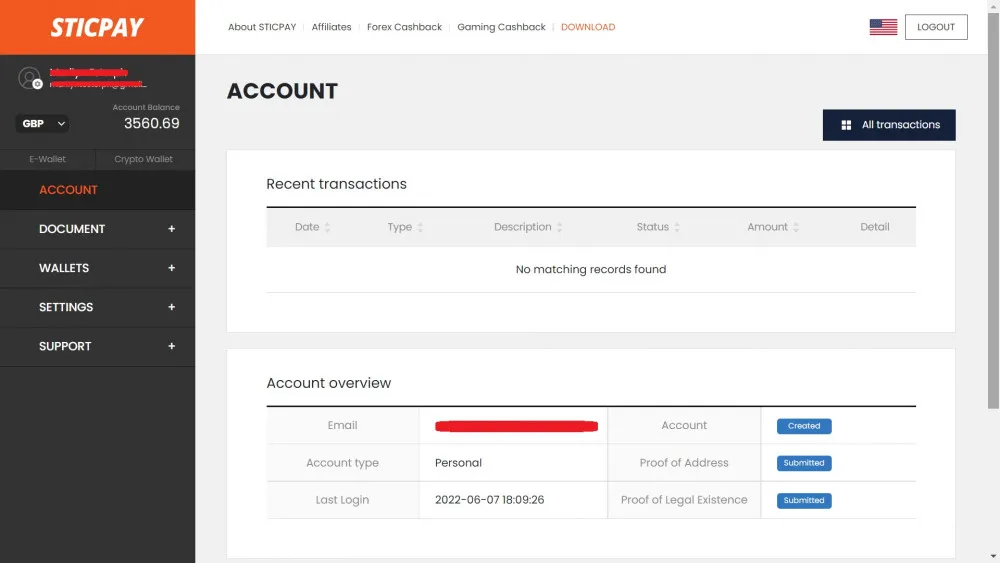

If you're more comfortable in accessing your account in a much larger screen, then you can simply sign in via their website with the same login details. The interface is pretty much the same as the mobile version so you won't get confused or get lost while navigating the interface.

In order to login to your STICPAY account, you will need to provide your email address and your password.

Now you might wonder if it's safe to login with these 2 basic details. Not a problem because you can enable your account to use the two factor authentication (2FA).

This is an added layer of security that will require you to complete the user verification to confirm your sign-in process. All you need to do is get the authentication code that they will send to your registered email or phone number (depending on which option you selected) and enter it on the login page.

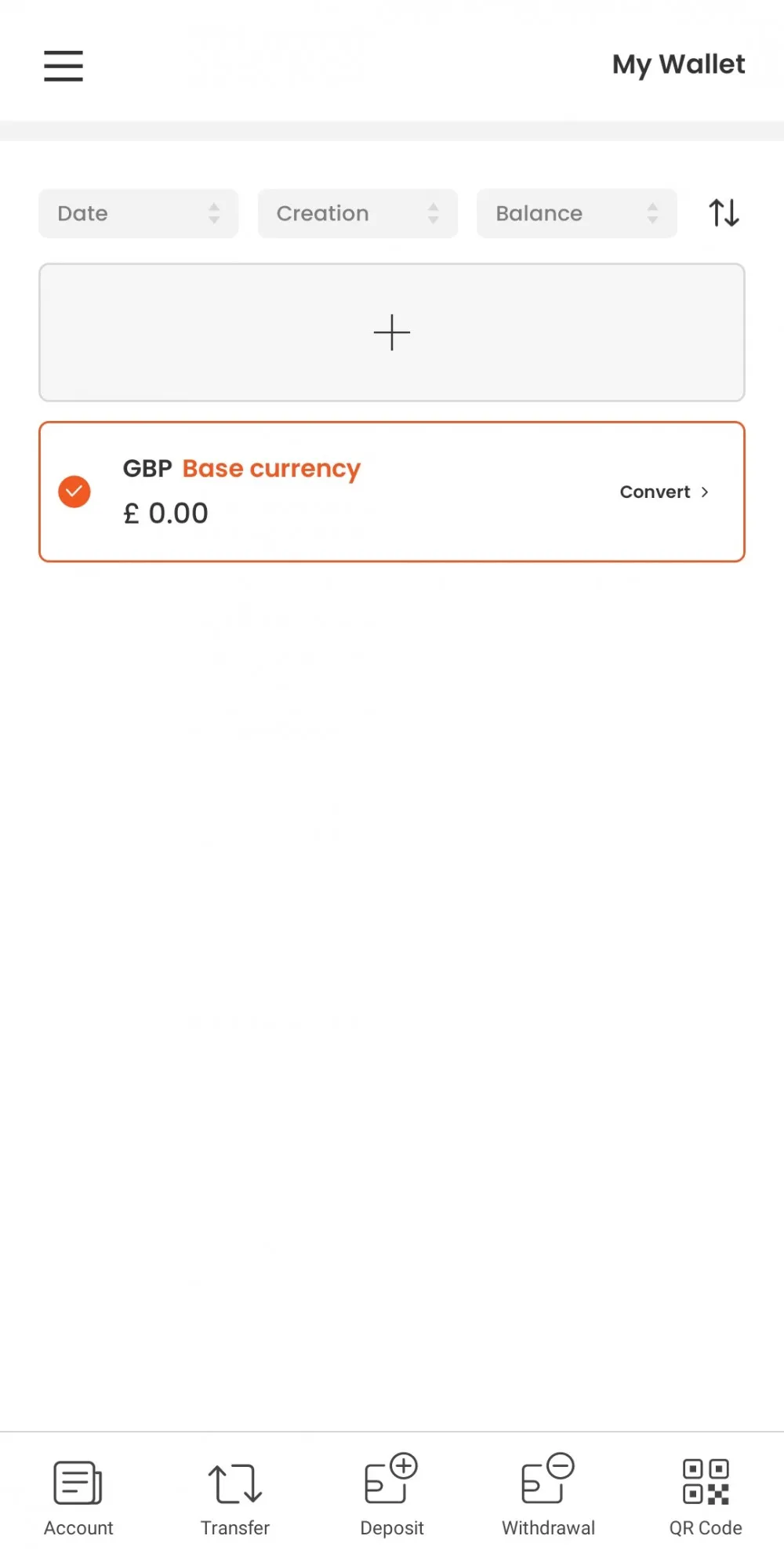

The Account tab or icon, which is the default interface that you will see when you open the app, will show your current balance and the most recent transactions you made complete with specific details including the date, status and amount.

The basic features and functions can be utilized on the digital wallet. You'll be able to transfer funds into another account, make a deposit into your account, withdraw funds and even scan QR codes for quick payments or transfers. You can also generate your own QR so other STICPAY users can quickly send funds into your account by simply scanning it.

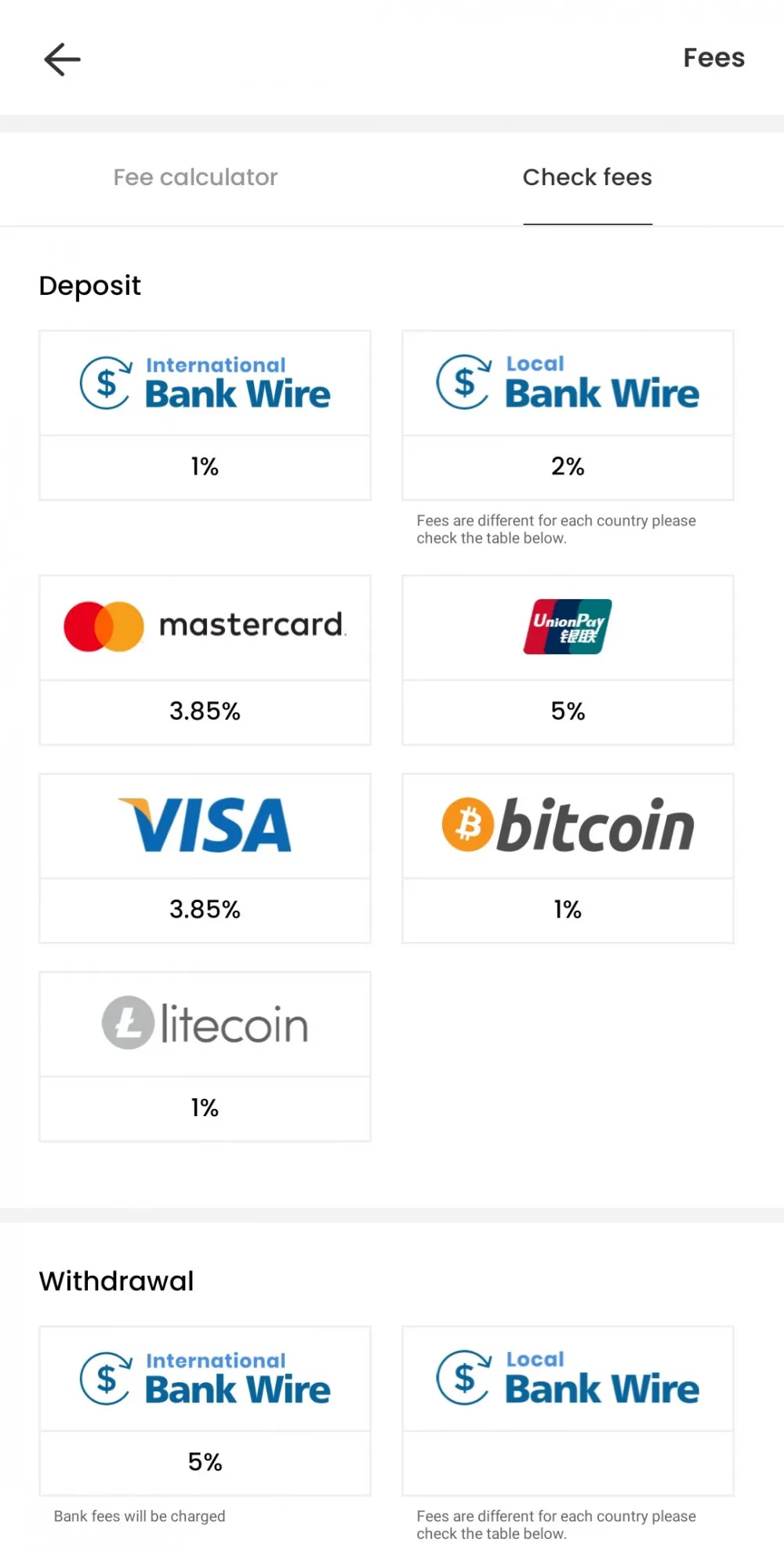

Here's the deal: The fees are clearly indicated on the app so you'll know the charges that you will incur for any transaction.

Deposits via international bank wire have a flat fee of 1% while local bank wire is at 2%. MasterCard and Visa deposits have a fee of 3.85% while UnionPay is at 5%. If you're going to make a deposit via crypto specifically Bitcoin or Litecoin, the fee is just 1%.

For withdrawals, international bank wires have a fee of 5%. For local bank wire, the fees are different for each country. If you're going to use UnionPay, the fee is 30 CNY + 2.5%. STIC Card withdrawal fees are lower at 1.3%. For Bitcoin, the fee is 0.00077000 BTC + 3%. Cashing out via Litecoin will incur a fee of 3%.

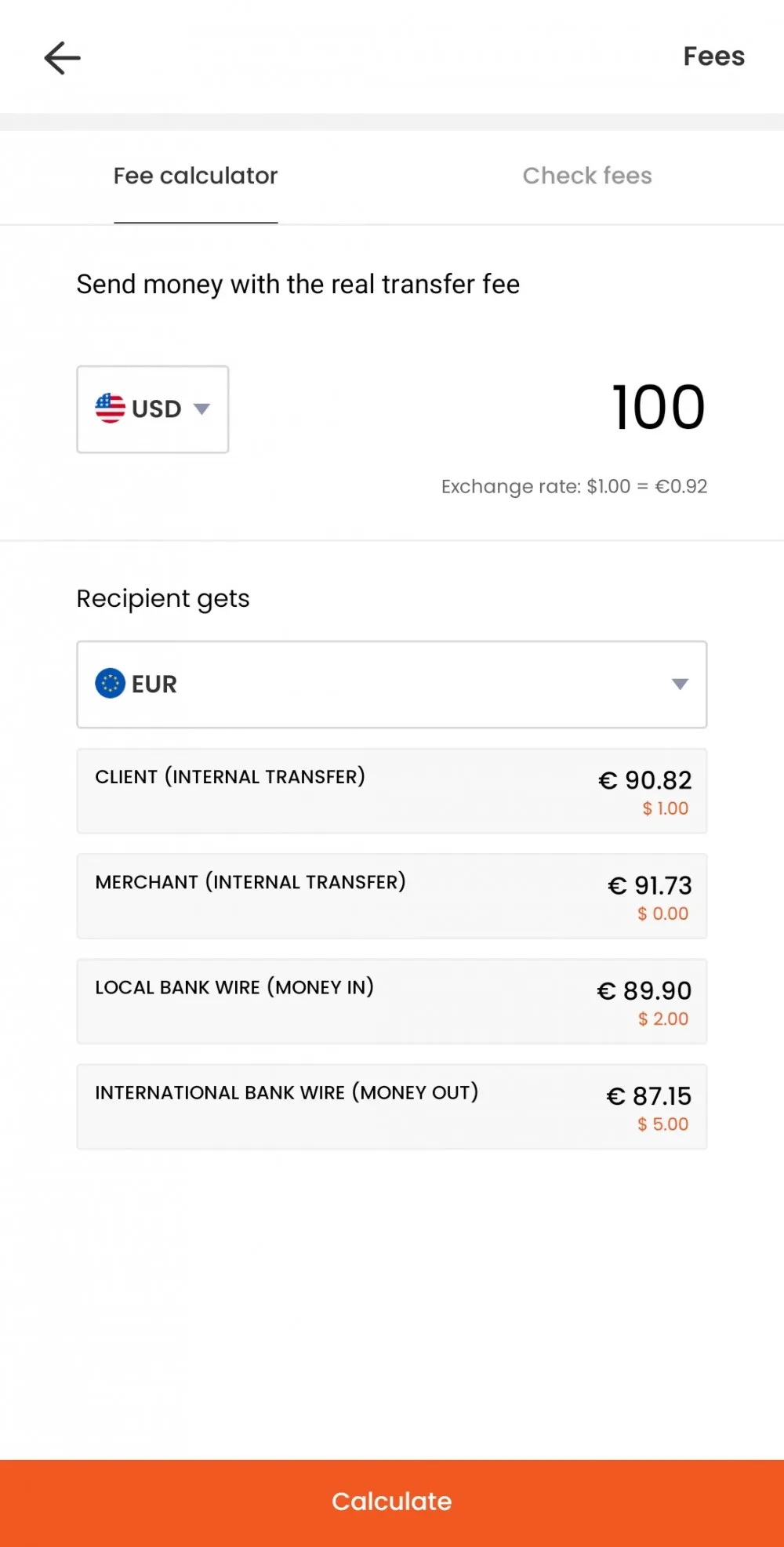

Here's a tip: You can get a list of all the fees by clicking on the hamburger menu on the app (the three lines) and then selecting Support and then Table of Fees. You'll also find there a fee calculator so can get a quick estimate on the real transfer fee that you might incur for sending money to another account.

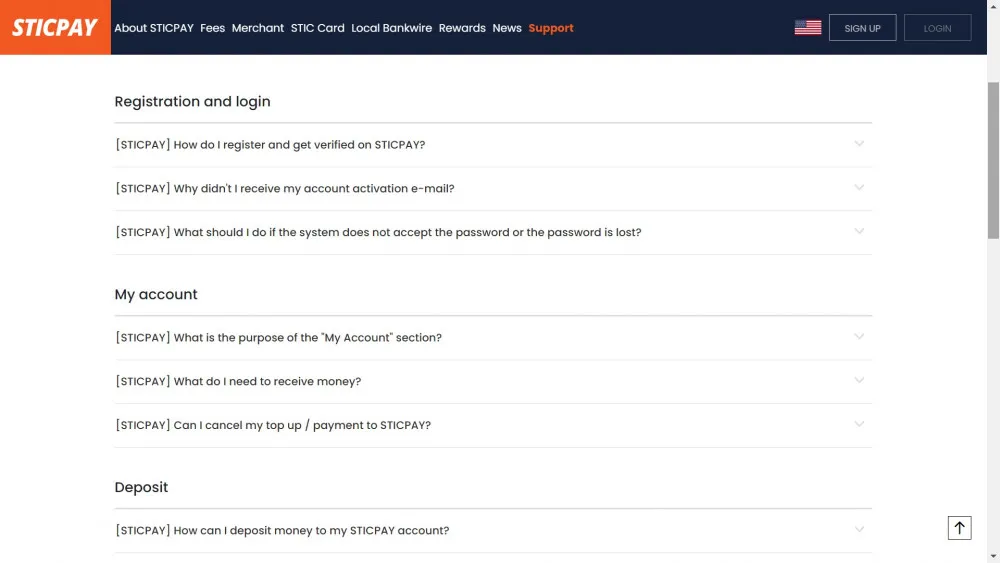

We strongly recommend that you check out their FAQ page first prior to contacting their customer service team. This particular page has a lot of useful info and might have the answer to your question.

If you can find the right information that you're looking for, then the next best step to take is by contacting one of their agents.

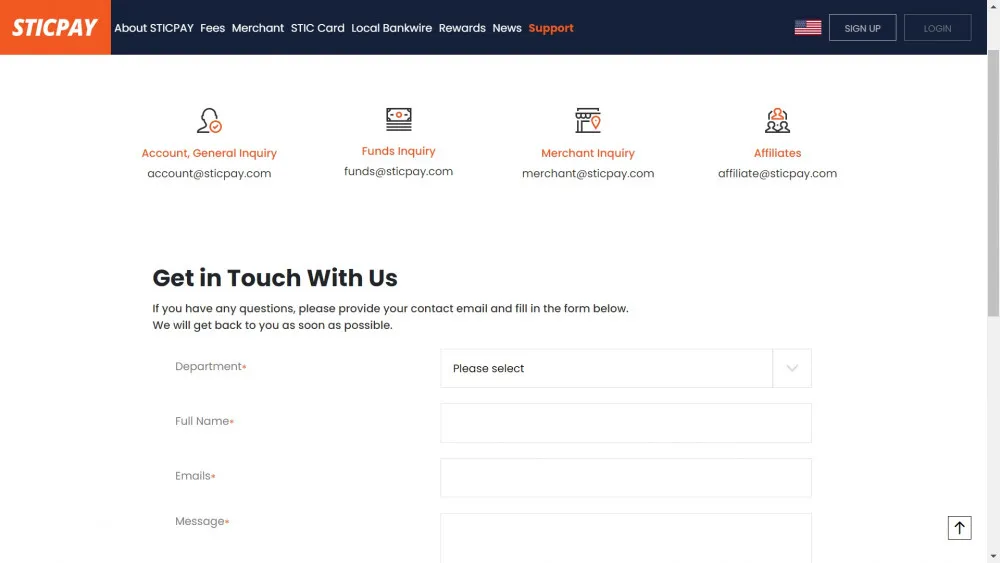

STICPAY doesn't have any phone or live chat support so the only way to get in touch with them is via email or by sending your concerns via their website's contact form.

There are assigned departments to handle specific concerns and these are the following:

Be sure to send the message to the right department so that your questions or issues will be handled or addressed properly.

The good news is that their support agents are available 24 hours a day so there's always someone who can attend to your ticket. Based on our experience, we were able to get detailed answers in less than an hour. We tested in the morning, afternoon, night and late night, and we were able to get responses in an hour on average.

We were very satisfied with our experience in testing STICPAY's e-wallet service. All the basic features are there and there are even some added perks such as cashbacks. Their fees are quite reasonable and they are very transparent with this so you'll know what possible charges you may incur for a specific transaction.

As for customer service, the lack of phone and live chat support may be a disadvantage but they clearly made up for this by providing client assistance that are capable of handling and resolving issues and queries in such a shorter timeframe.

Overall, we highly recommend STICPAY for those who are looking for an excellent e-wallet service that is safe, stable and trusted.