Chime is a mobile digital bank that started its operations in late 2013 based in San Francisco, USA. This financial technology or fintech company provides an alternative to standard financial services for practical purposes and convenience, such as fee-free online banking transactions and automated features.

Chime doesn’t have a full banking license to operate like the traditional banks. Still, it collaborates with FDIC-insured banks such as Bancorp Bank and Stride Bank to develop more competitive services with improved financial and lower-cost solutions for Americans.

| Operator | Card | Reliability | Best in | Score | |

|---|---|---|---|---|---|

#1

|

Visa, MasterCard | Low and transparent fees with mid-market exchange rates | International Money Transfers | 97 | Open Account |

#2

|

Visa | Online banking with no monthly fees | Spending Account | 96 | Open Account |

#3

|

Visa | Hybrid banking with quality support | Hybrid Banking | 94 | Open Account |

Chime's banking services primarily offer three types of accounts, namely::

The Spending account, also known as the bank’s checking account, prides itself on having no fees upon opening. It is linked with the Chime Card and the Visa Network, making it more accessible to many users. They have the “early direct deposit process”, which could make your direct deposit available up to two days early upon establishing your direct deposit in your spending account. They have a cool feature called SpotMe, allowing users to overdraw their account by up to $20 of their debit purchases without additional charges. The only downside is that this feature is only available for account holders who have a direct deposit of $200 each month..

The Savings account works well with the Spending account. It offers only one saving option called “High-yield saving account” and has a savings rate of 0.50 APY. We also like that they have two optional automatic savings programs; “Save when you spend” and “Save when I get paid,” this is the best feature of Chime’s Savings account.

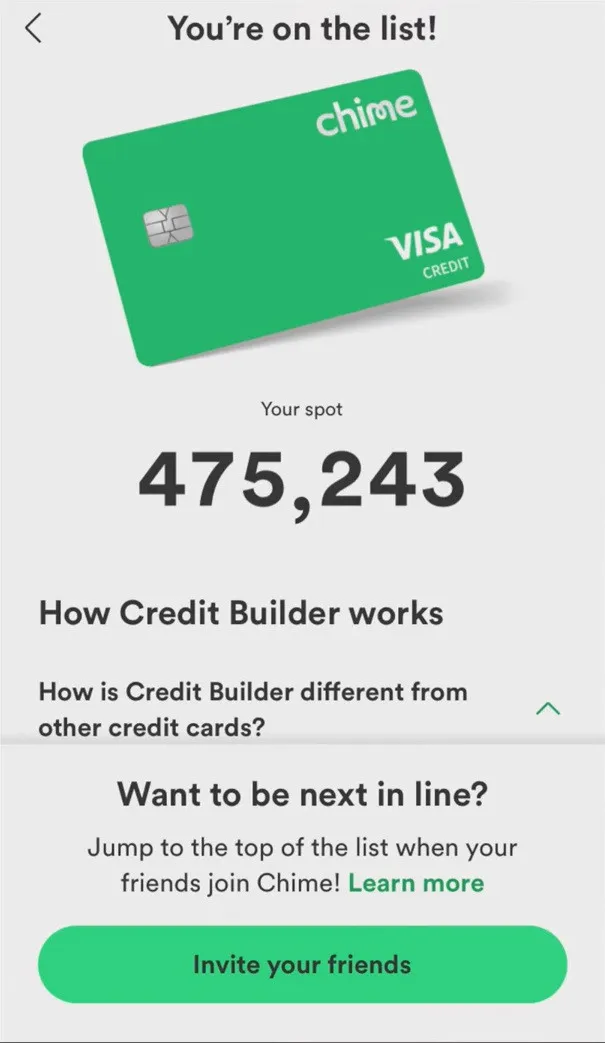

Lastly, they also offer a Credit Builder account, which works like a secure credit card that helps users build credit without much risk for a bank. By adding money into it through your Chime Spending account, you can make purchases with a Chime Visa credit card, and it will be reported as paid in full with a 0% interest rate and no credit check.

Chime’s banking services are accessible in any web browser, and they also have a mobile app that is remarkably convenient to users for they can access the bank’s services anywhere.

As an online bank, it is also vital to provide the best experiences for users on any platform from the web to mobile devices, and the good news is that Chime has already been one step ahead of its competitors.

Their website design is simple, yet it is organized from the category of the products they offer, features, accounts, and other relevant information for the user’s need and brings them easy navigation in their apps and site, giving a great experience to the users.

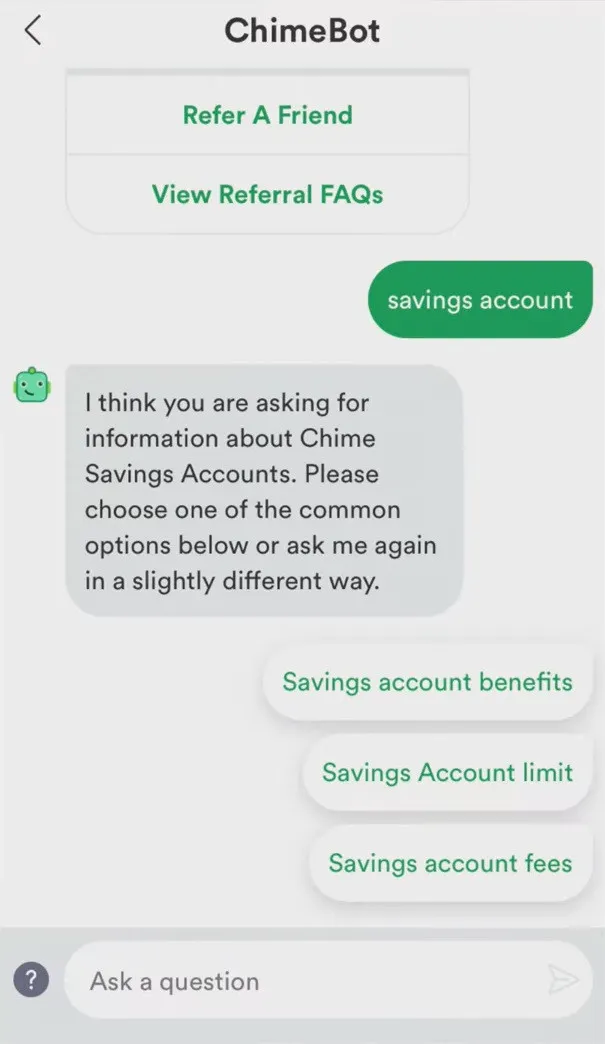

When it comes to the mobile app, you can freely use it without any issues, for they are compatible with iOS and Android. Like their website, it is also optimized and well designed for users. You’ll be able to track your expenses, locate ATMs, and access money transfer services. Additional features of their Mobile app include daily balance updates and real-time transaction alerts for their users.

The Chime app is proven to be user-friendly and has features that benefit and give accessibility to its users. They also review and make updates and improvements to their apps and websites, so this is a clear indication that they aim to provide quality customer service for their clients.

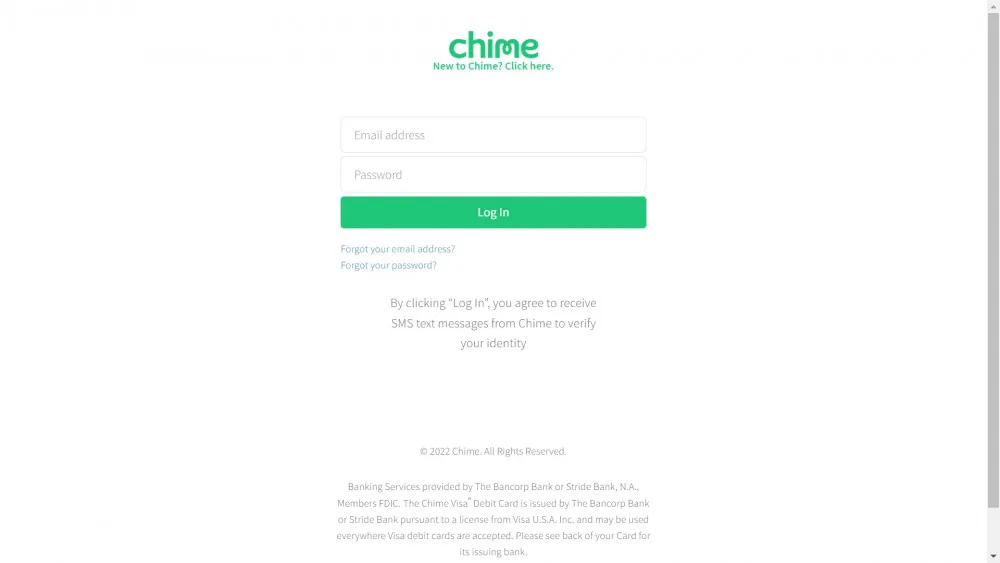

You have the choice of logging in to your account via their website www.chime.com or their mobile app. You'll only need to provide your registered email address and your account password in order to successfully sign in.

If you're going to do the Chime login via the app, you'll need to set a 4-digit pin or use the two-factor authentication and fingerprint verification if your device has this feature..

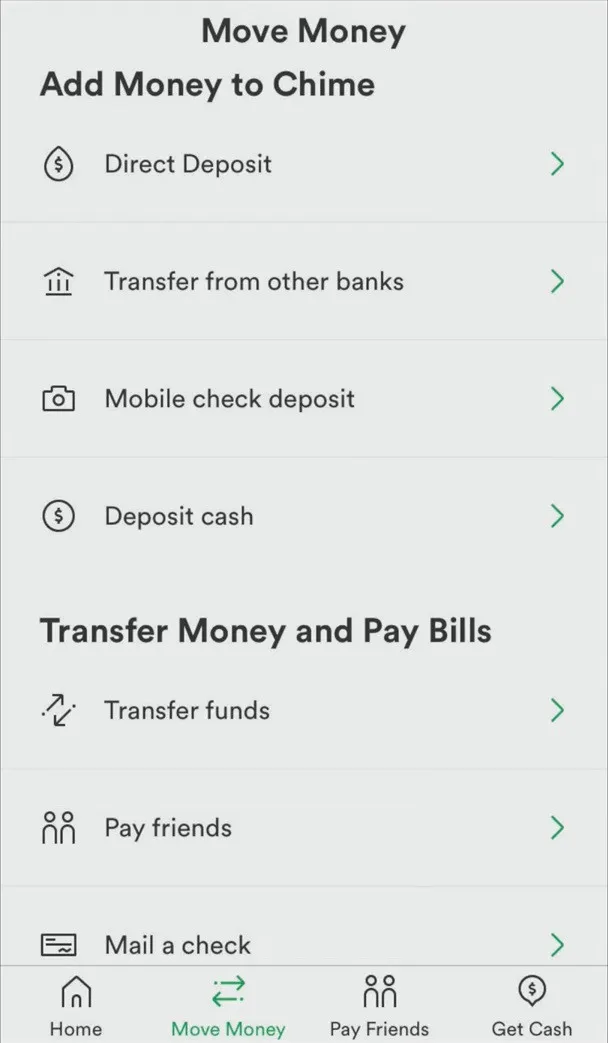

You can stay on top of your money using Chime banking features. Here’s what Chime can offer you:

Opening a Savings or Spending Account in Chime is free with no monthly fees, overdraft fees, cash deposit fees and does not require a minimum balance. In fact, this bank takes pride in its lack of fees for majority of the banking services that they provide and while there may be charges for specific services, these are all clearly stated in their app or website.

In addition, getting their debit card is free of charge, including delivery fees and some misfortune circumstance fees such as loss, stolen and replaced cards. International transactions are also free when using a Chime card.

Furthermore, ATM withdrawal in the USA networks in Visa Plus Alliance (VPA), MoneyPass, and Allpoint networks is accessible. However, there is a $2.50 fee charged for every withdrawal transaction made outside of the US border and outside of mentioned networks, and they also may charge additional fees with it. In addition, there is a $500 daily limit for every ATM withdrawal transaction. You can enroll in Chime’s SpotMe service if you make a direct received deposit of at least $200 each month. They also offer an optional service that allows you to overdraw your account by up to $20 on your debit card purchases without a fee.

Although transfers from Spending accounts to other Chime members and ACH transfers (Automated Clearing House) are free, there is a transfer limit with a charge when using ACH to transfer money to Chime, which is $25,000 per calendar month and $10,000 per calendar day with no restrictions or limitations on the number of times per day.

Chime offers short-term loans in cash advances to cover an emergency or unexpected expense. This loan can be a quick way to get money when you don’t have sufficient funds at your disposal and need cash immediately in case of a one-time emergency.

Moreover, when you plan to loan a cash advance, you must first research the options and wisely choose the right cash advance type for your situation. Cash advance has four main types of cash advances—credit card cash advances, payday loans, installment loans, and merchant cash advances.

How does it work?

All of these cash advance options can deliver you cash immediately, but each option differs on how they work. For example, payday loans are short-term loans that may cost you in the long run as it is notoriously expensive for consumers. This loan option is designed to provide a lower-cost alternative in which you can borrow up to $1,000 with a loan term ranging from 1 to 6 months. However, keep in mind that this option carries relatively high-interest rates capped at 28% by law.

In addition, a cash advance credit card works like withdrawing cash from an ATM in a similar way to using a debit card, but the main difference is where the money comes from. With this, you are obliged to pay back the advance with interest.

It’s important to remember:

Customer service quality and the availability of their support staff are some of the most critical aspects that you need to consider when finding a bank to trust with your money. And while customer service seems to be essential for Chime to ensure a competitive advantage over other financial institutions; however, having no physical location puts its service at a considerable disadvantage.

For example, you’ll never be able to converse with somebody face to face about any issues you’re currently encountering, as you can only reach them by phone, email, or in their mobile banking application. Because of this, the level of customer service provided by them is considered by many as average in the banking industry since it doesn’t have any robust customer service platform to resolve consumer issues.

On a better note, Chime is constantly updating its application with the help of technology to provide adequate customer service to satisfy your banking needs.

Now, if you have concerns regarding their services, you can contact the customer support department via the mobile app or email them at [email protected]. If you’re the type of user who still prefers an actual voice conversation over the phone, then you can dial 844-244-6363 from 3 am to 11:00 pm (Central Time) every Monday to Sunday.

Take note: There is no live chat option from their website, although there is a link from the “Contact Us” page of their social media platforms such as Facebook, Twitter, and Instagram. If you have an issue and want a speedy resolution, we advise you to contact Chime Customer Service via their phone number.

As online banking becomes popular, Chime has its way of providing banking services in just a single mobile device. They have a wide range of financial offerings easily accessible via their mobile app, making it efficient for you to engage in different transactions and avail of their services.

Despite their excellent features, they have no physical locations where you may obtain assistance whenever you have issues or concerns regarding their services. However, having no physical location means that you won’t have to queue or take time to visit their office to reach out about your problems. Instead, you can contact customer service 24 hours a day, 7 days a week, through their app, email, or phone number.

Overall, Chime is one of our top choices for online banking. If you are searching for a basic banking alternative in the US and don’t want to deal with numerous overdraft charges, this banking approach may be of interest to you.