Ally is an online bank that started as General Motors Acceptance Corporation (GMAC) in 1919 to help dealers finance and sustain their inventory. Later, in 2009, GMAC was converted to what Ally Bank is today. It offers a wide range of services and products, including deposit accounts, credit cards, investment products, home loans, and more.

Ally Bank is a famous online bank to people looking for reasonable rates and excellent customer care. Because they don’t have to spend money on building and maintaining physical branches, they can offer better rates and cheaper fees than many brick-and-mortar banks.

| Operator | Card | Reliability | Best in | Score | |

|---|---|---|---|---|---|

#1

|

Visa, MasterCard | Low and transparent fees with mid-market exchange rates | International Money Transfers | 97 | Open Account |

#2

|

Visa | Online banking with no monthly fees | Spending Account | 96 | Open Account |

#3

|

Visa | Hybrid banking with quality support | Hybrid Banking | 94 | Open Account |

With Ally, you have plenty of options when it comes to managing your daily finances as it offers three types of accounts that may satisfy your banking needs:

These three accounts have something in common: all of them fall under a deposit account. In other words, all of the money you put in checking, savings, or money market accounts will most likely generate interest as Ally utilizes those funds to lend and make investments. However, they all differ in terms of accessibility, interest rates, and other factors.

Checking accounts do not generally earn high annual percentage yields (APY), but they can be helpful for daily expenditures and bill payments. Hence, it allows you to access your money in many ways, so you can transmit money, make withdrawals from an ATM, and so on with most banks.

The money you allocated to your Savings account earns daily compounded interest, often at higher rates than the other two accounts. It can be a perfect place to store your funds for short-term goals, as you can withdraw them anytime. However, the federal government decided to limit the number and types of withdrawals per statement cycle to encourage and motivate people to use them as intended and save as much money as possible.

Money Market accounts offer a 50% annual percentage yield on all balance tiers. The good news is that even with this type of account, there’s no monthly maintenance fees or minimum balance requirement, which means you can earn a considerable amount on your account balance while also having check-writing and debit card access.

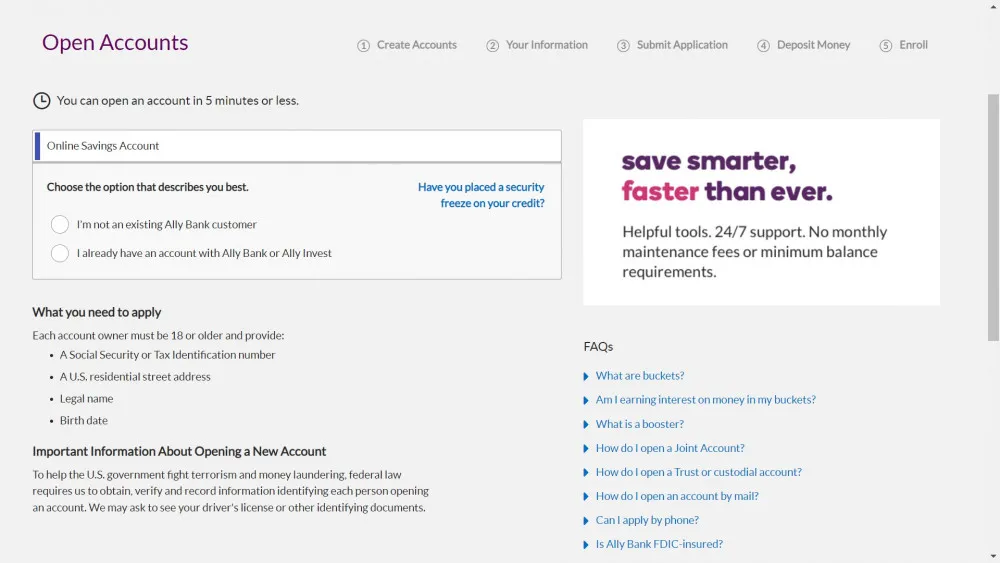

Opening a bank account with Ally only takes a few minutes of your time. You can follow the simple procedure below:

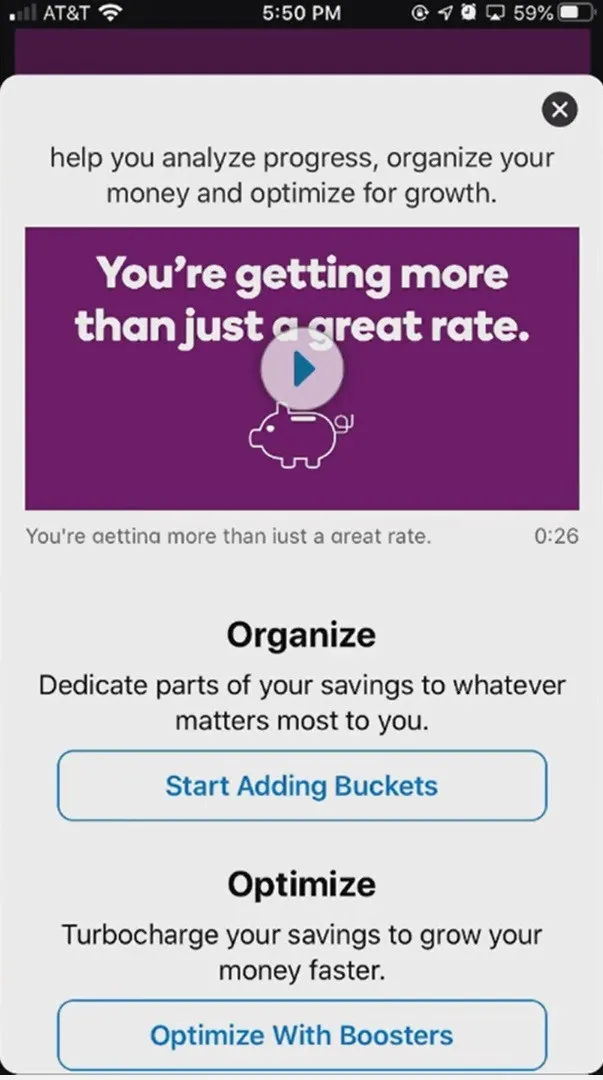

As most banks worldwide use online applications to provide better and more accessible services to customers, Ally Bank has done the same. They created an accessible web version and a mobile app for easier access to banking needs.

And what’s great is that they made sure that it features a smooth and bug-free interface so you can access your account on the go. But, unfortunately, not all features are available in the web version. The complete feature set is only accessible via the iPhone and Android apps, so if you have one installed on your smartphone, then you will be able to do the following:

Here’s what you need to know:

With the web version, you can only find ATMs, check balances, and pay your bills, so we suggest downloading the mobile app instead as it is more practical and organized.

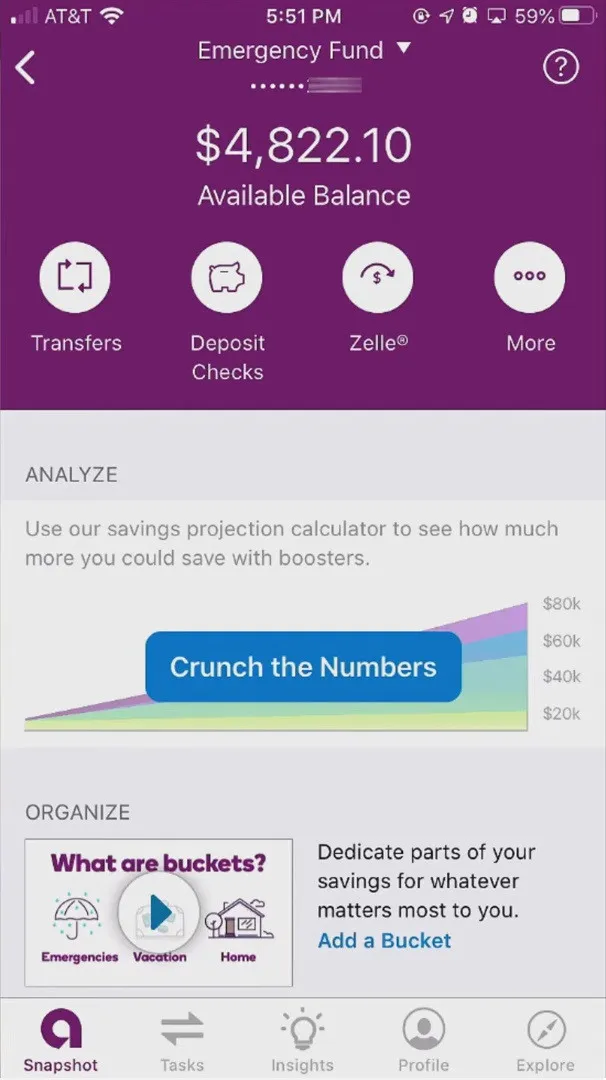

The Ally Banking app displays total balances on one page, with individual balances stated on the side for more precise visibility. It is a great banking app for beginners as functions and tools are very straightforward. However, when you’re already familiar with Ally’s banking features, learning to navigate the app is a piece of cake.

Users should first register their accounts for an online banking account to utilize the app. Once you have an account, all the convenience brought by the app is easy to take advantage of. There is also live chat support for any general concerns..

And better watch out for extra cool features! One worth mentioning is that you can access Ally information by calling out “Alexa”. Meaning, you can do voice commands to check your balance or inquire about products. You won’t find this kind of feature with an ordinary bank!

A username and a password that you registered during the sign-up process are the only requirement to login to your Ally Bank account. If you're going to use the mobile app, you have the option to sign in using your fingerprint via the app's biometric features as long as your device supports it.

Given that there are various Ally login methods, you have the flexibility to access your account in a way that is more convenient and suitable for you.

There are three banking features in Ally bank that offer ease and aid in reducing excessive spending. These features are:

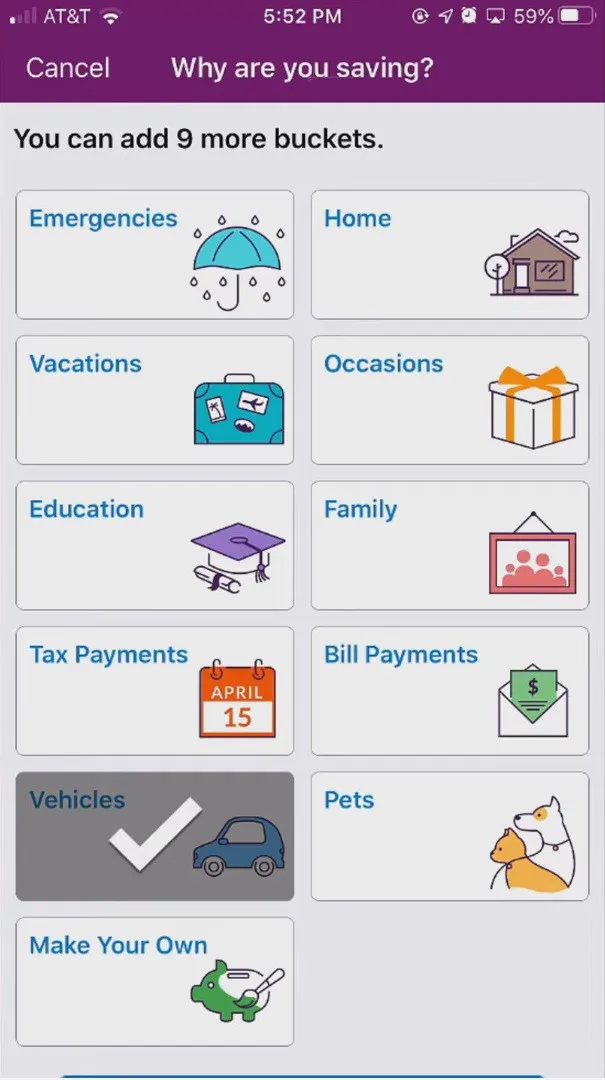

This operates similarly to the “envelope system”, allowing you to divide your money into several collective goals, emergencies, houses, bill payments, and many more. Ally offers some predefined buckets from which to choose, or you can construct your own by dividing your online savings account into multiple categories to help you visualize your goals.

You may be less likely to spend money if you don’t have quick access to it, especially on goods you don’t need. Using this feature, you can avoid impulsive spending, which can be helpful for those who are trying to stick to a budget. Every month, Boosters automate the transfer of funds from the checking account to the Savings Buckets, making saving money much simpler.

This examines your linked checking account for savings opportunities and automatically transfers funds to save up to three times each month. It’s incredibly motivating since Ally provides a high-yield savings account that pays a higher interest rate on your money than a traditional bank. So, the surprise savings function not only increases your savings rate but also lets you earn more money.

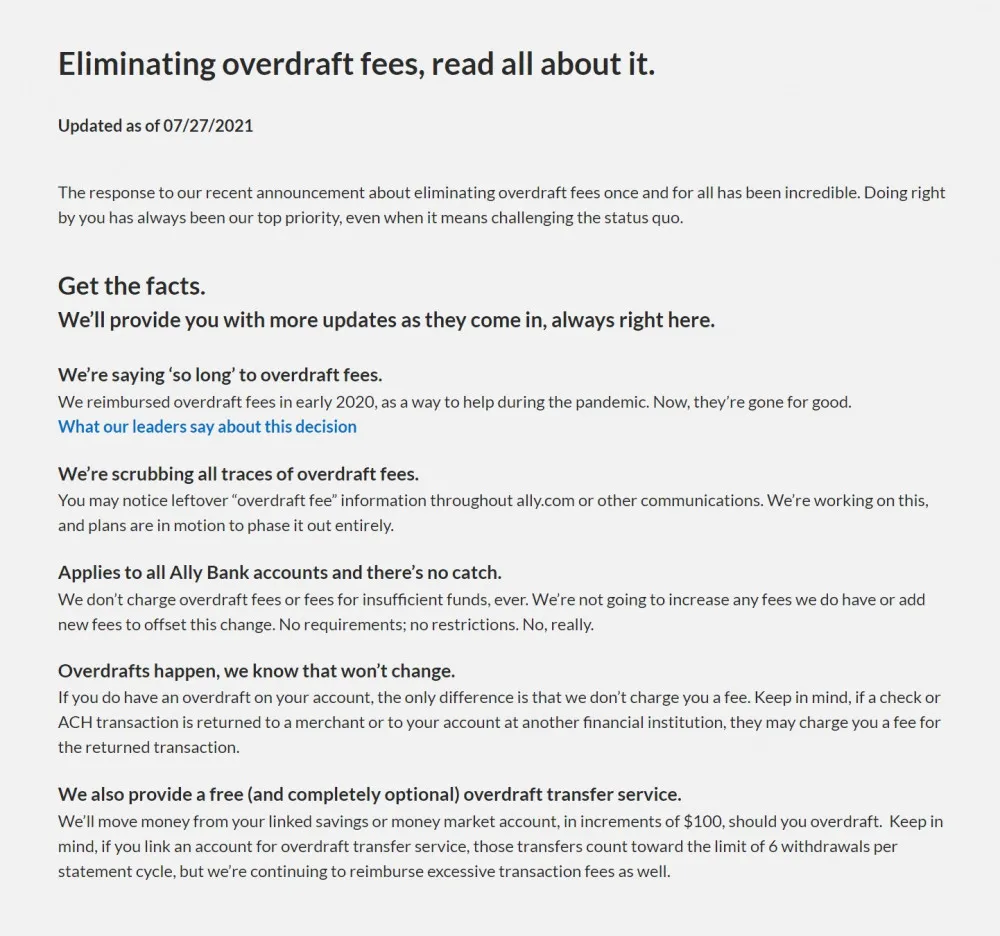

Because Ally Bank does not have physical branches, the bank can pass those savings on to customers in the form of lower fees. They also offer a checking product—Interest Checking Account, in which there are no monthly fees, no overdraft charge fees, and the best part is that it doesn’t require a minimum deposit.

Moreover, Ally Bank doesn’t charge a lot of services, such as monthly maintenance fees, standard or expedited ACH transfers, copies of online statements, incoming wires (domestic and international), postage-paid deposit envelopes, and official/cashier’s checks.

In addition…

Ally offers two savings accounts—Online Savings and Money Market accounts. Both have a monthly maintenance fee, but both pay higher annual percentage yields than traditional saving accounts.

Money market accounts include checks and debit cards that enable you to choose which good alternative to make withdrawals per month. For both saving accounts, it is free for monthly maintenance fee and overdraft fee while also same amount fee for excessive transactions of $10 each and $7.50 on returned deposit fee with a 0.50% APY or Annual Percentage Yield.

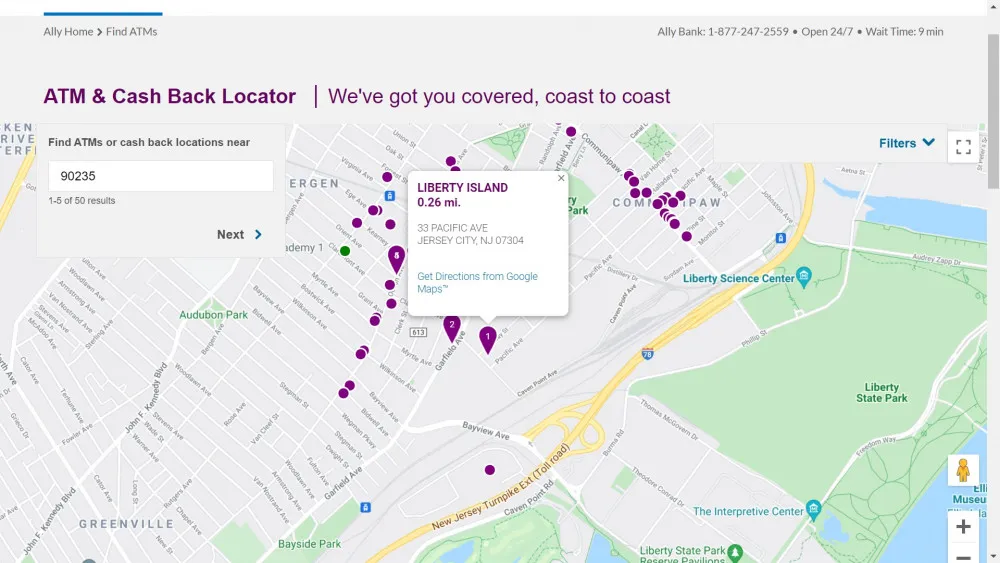

Ally's debit card can be used for making purchases in stores or online merchants that accept MasterCard. If you need instant cash, you can withdraw it at any of the 43,000 Allpoint ATMs in the US.

The Ally card can be managed via a feature called the Ally Card Controls App. You can turn your card off to disallow withdrawals, set merchant categories and spending limits, get push notifications and more.

Ally Bank doesn’t offer personal loans directly to its consumers. Instead, they have a corresponding division called Ally Lending that performs all its loaning activities, and it operates on a business-to-business-to-consumer model.

They offer loans through their partners, including health care providers, automotive centres, home improvement dealers, and retail platforms. That means if you’re planning to be a borrower, you must first apply for financing through these partners to get a loan from Ally.

So how does it work?

For a loan application, you will be given access to the Ally lending platform, and from there, you will need to complete the process to proceed with the application. There is no down payment or other fees in applying, and you could get prequalified in a couple of minutes.

Then, you will choose from the different loan options presented, and you will submit a formal application after. After Ally does the credit check, you will receive a notification if the loan was approved, and there will be a billing statement mailed together with instructions on how to set up your account.

Meanwhile, Ally will fully pay the amount you need to your provider, and it will leave you a loan that you will pay back to Ally.

All the loan options ranging from health care, home improvement, retail, and auto loan have a fixed annual percentage rate based on the borrower’s loan terms and creditworthiness. And because the APR ranges widely, your credit and your chosen loan terms will have an impact on what your interest rate will be.

What's worth mentioning is that Ally Bank's rates are considered as among the most competitive in the US. They offer interest rates that are compounded daily so you can grow your funds faster. A savings account with this bank has a a 0.50% rate or Annual Percentage Yield (APY) across all balance tiers. Such rate is much more attractive then the US national average which is just 0.06%.

Keep in mind that Ally rates may vary after opening an account.

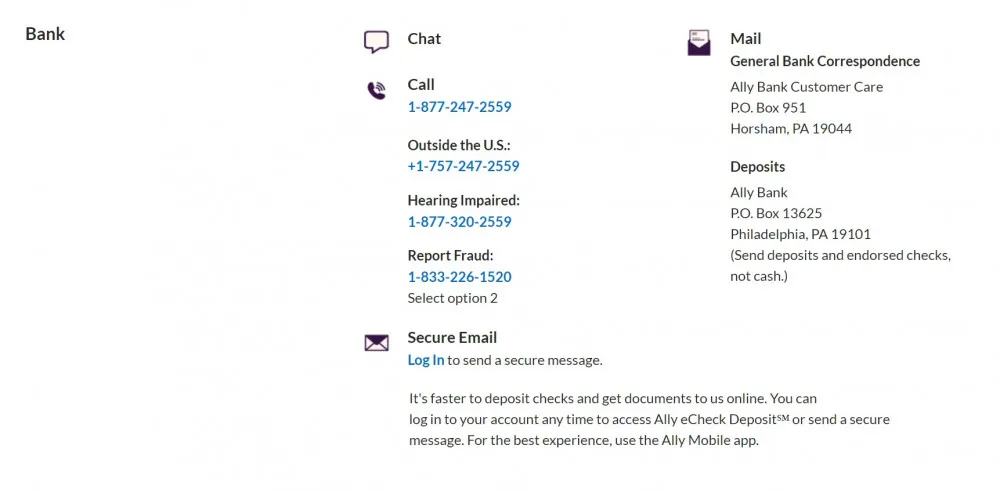

What’s excellent about Ally bank’s customer services is that it offers four different communication modes for a customer to reach them; phone, chat, web and email.

The bank provides 24/7 customer service via phone, live chat, or email. The Customer Service department that responds to your emails is used to dealing with a wide range of customer service issues, such as Account Recovery.

Email can be a comfortable form of communication with customer service because you can focus on other things while doing so, and you may already be checking your inbox frequently. For example, when you email Ally Bank, one of their customer service representatives in their call centres will receive your message and respond to you on a first-come, first-served basis. That department is open for customers 24 hours a day, seven days a week.

The downside? You won’t get a response until the next working day if you send an email late at night.

Fact: Ally bank customers prefer to talk to a live human being. A recent survey shows that over 90% of their clients were satisfied and happy with the service they received via phone call with the bank’s customer service team.

In addition, when you visit their homepage, you will most likely encounter their “award-winning timer”, which will tell how long you will wait to have someone to talk to from the bank. On top of that, you will indeed have someone to talk to every time, and anytime you call.

In general, you have four ways to get in touch with an Ally customer service representative, but if you need a speedy response, we’ve realized that reaching them via phone call is the fastest and best option.

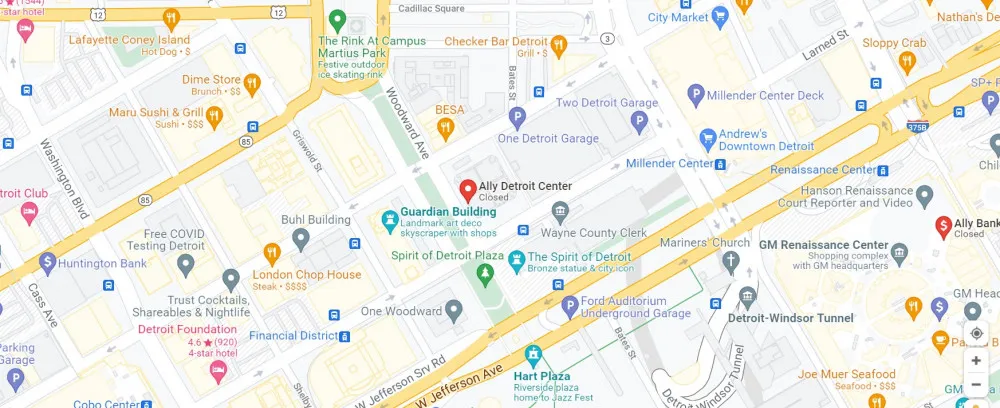

To begin with, Ally only has a single branch located in Utah. Since this is an online bank, it doesn't actually have any other physical branches. As an operating company, they do have a corporate headquarters in Detroit, Michigan and several corporate center locations but these locations do not provide regular banking services since you are expected to do most things on your own.

The Ally address for the lone branch is located at 200 West Civic Center Drive, Sandy, Utah 84070.

Ally Bank mainly offers a lot of no-charge fees, which is a breath of fresh air for their consumers. Therefore, we recommend this bank to those interested in low fees, no minimum deposit requirements, and better rates.

And even though Ally doesn’t deal directly with the consumer for loan services, they still offer a wide range of loan services. These may benefit most businesses because of their Business-to-Business-Consumer model. These businesses that partnered with Ally act as middlemen and borrowers in the lending transactions, which also benefits the company because they will be paid in full by Ally for their service or products rendered to the borrower. And in any case that you have questions or need customer assistance regarding your account, you can reach them through four different channels.

So if you are in the USA, then Ally Bank is worth strong consideration if you want to save and grow your money at higher-than-average rates; they offer full banking functions for your financial needs.