Intro

If you're interested to open an account with a digital bank, then N26 and Digital International Bank are among the top brands that you should consider. If you can't decide between these 2, then take a look at our detailed comparison so you can see the difference.

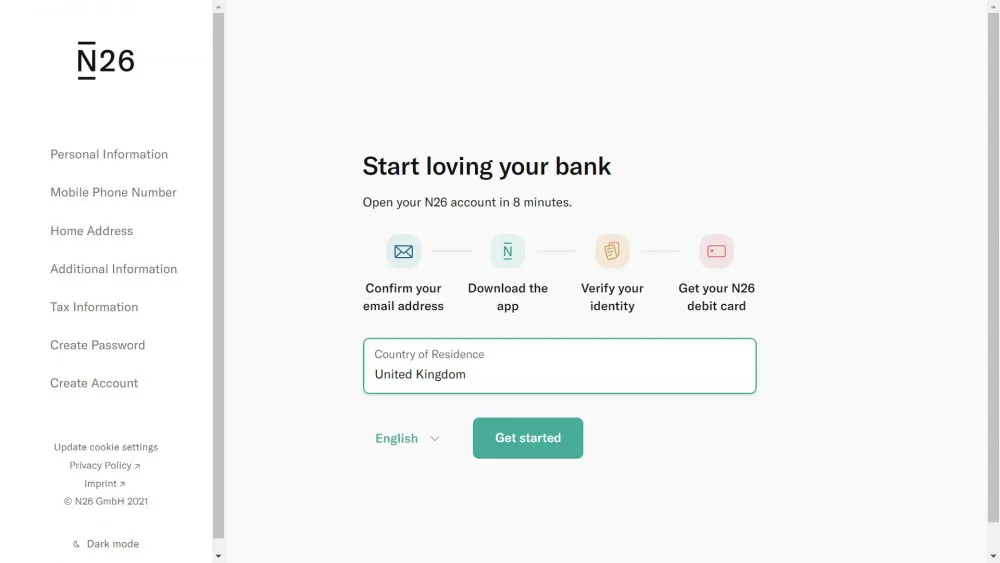

As of this writing, N26 accepts residents from 22 European countries including Austria, Belgium, Denmark, Estonia, Finland, France (excluding DOM/TOM residents), Germany, Greece, Iceland, Ireland, Italy, Liechtenstein, Luxembourg, the Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, and Switzerland

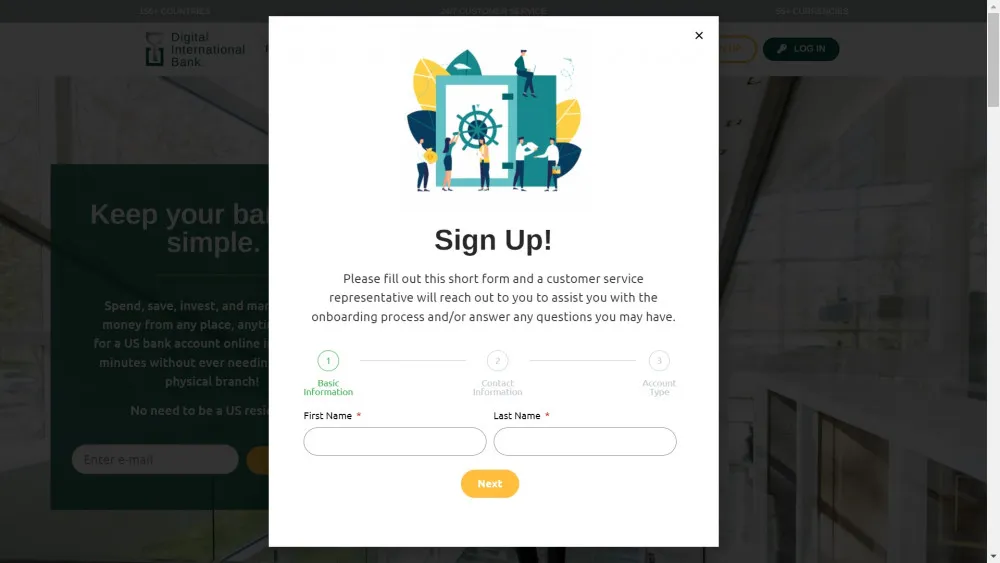

In comparison, Digital International Bank accepts registrations from residents of more than 150 countries including those from the US and UK which gives them the advantage.

Since N26 only accepts residents of specific countries from Europe, the only currency that they support is the Euro. This pales in comparison with Digital International Bank which supports multi-currencies. With DIB, you can save on exchange fees as the bank will directly accept the original currency and won't convert it to another one.

In this category, both DIB and N26 are a tie as both banks offer the MasterCard card. They don't offer Visa brand.

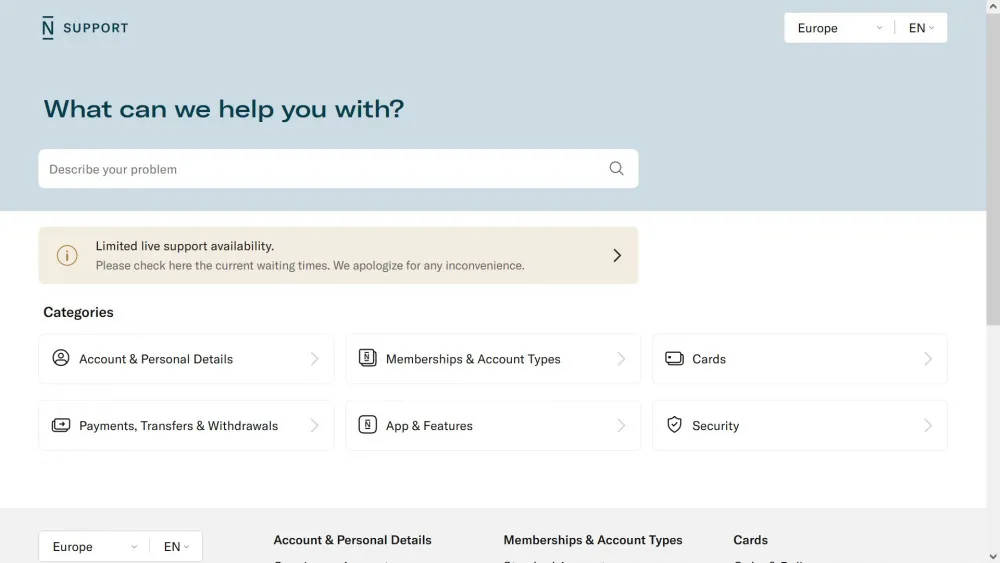

Contacting the N26 customer service team can be done via phone, email, live chat, and even social media.

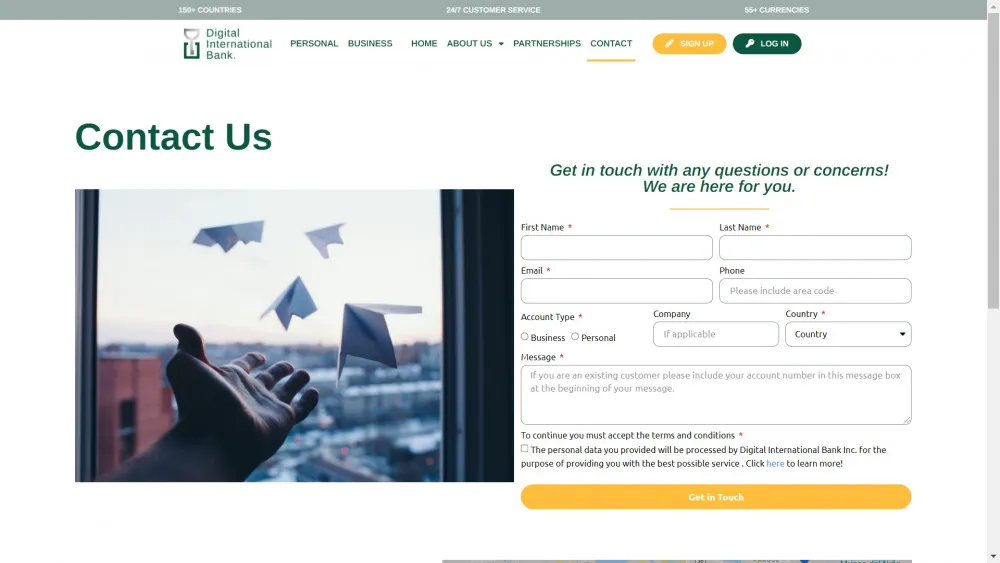

DIB's support on the other hand is available via phone, email or even video chat. They have the slight edge as they offer video chat which gives a more human touch since you'll be able to see their agents in real time on a screen rather than just by the traditional chat.

N26 has established its name as a trustworthy neo-bank in Europe with its user-friendly app. Since most banking activities can now be done online, it is one of the top picks of frequent travelers and digital nomads.

What makes DIB highly popular in the digital banking industry is its hybrid banking service, which is a combination of digital and in-house services. On top of that, they are a fully licensed US bank and is regulated by the OCIF (Office of the Commissioner of Financial Institutions) in Puerto Rico.

N26 and Digital International Bank are on the top of the list if you’re looking for highly reputable neo-banks to entrust your money. Both offer convenience to their clients with their reliable digital banking services. N26 is a popular option for frequent travelers while DIB is the top choice for those who are looking for a digital bank that offers a more personalized touch. Overall, you have 2 great options but basing it on the comparison that we did, Digital International Bank has the edge.